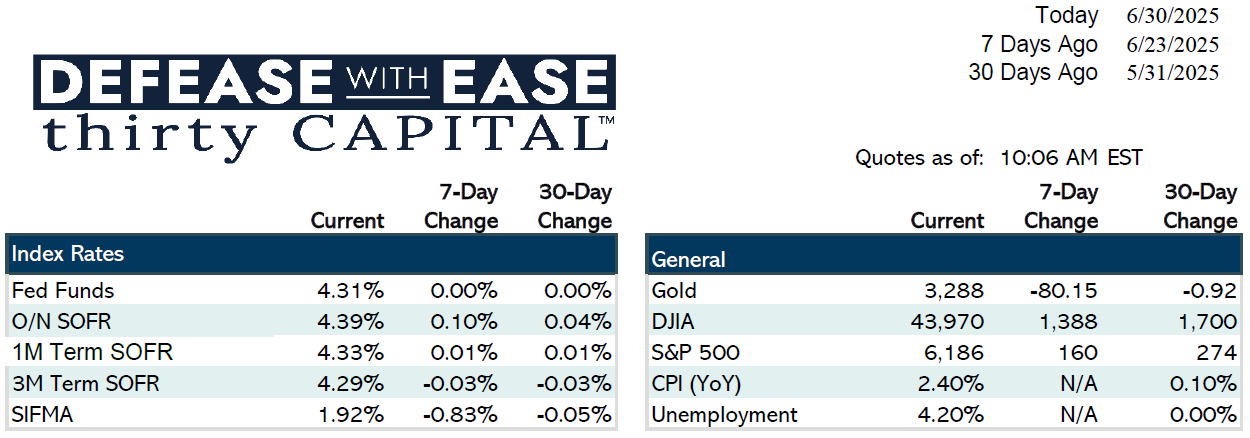

Markets continued to trend lower last week as a combination of soft economic data and growing expectations for Fed rate cuts weighed on yields. Treasury and swap rates declined across the curve, with two-year swap rates falling 16 basis points and 10-year swaps down 11 bps on the week. This marks the third consecutive week of declines in short-term rates.

Economic Data Recap

- PCE Inflation: Core PCE rose 0.18% month-over-month, broadly in line with expectations. Annualizing the last three months puts core inflation around 1.7%, with super core closer to 1.2%, signaling disinflation momentum.

- Consumer Data: Consumer confidence dropped sharply to 93 (vs. 98 prior), while consumer sentiment edged higher.

- Labor Market: Initial jobless claims came in at 236K—below recent averages—though continuing claims ticked up, suggesting a labor market that is stable but not expanding. Hiring remains soft, particularly for new graduates.

Market Outlook & Fed Expectations

Market pricing now reflects a near-certainty of a Fed rate cut by September, with about 20% odds for a July move. Traders are forecasting over 130bps in cuts through 2026—well above the Fed’s own guidance of three cuts over that period. This divergence is driving short-end rates lower and fueling expectations of a more aggressive easing cycle.

Borrower Strategy & Origination Trends

Floating-rate appetite has picked up amid falling short-term yields. Borrowers are being advised to favor floating-rate structures or shorter-term fixed-rate loans (e.g., five-year IOs). On the hedging side, shorter-term caps (6–12 months) and swaps are preferred, as longer tenors may be mispriced in a falling rate environment. Forward-starting hedges are beginning to look more attractive for future funding or cap extensions.

This Week

Markets will be focused on key labor data, with JOLTS on Tuesday and Nonfarm payrolls Thursday (survey: +113K; unemployment rate: 4.3%). ISM services and Weekly Jobless Claims are also on deck. The bond market closes early Thursday and is shut Friday for the July 4th holiday. Volatility remains subdued, and barring surprises in this week’s data, markets may drift into a quieter summer pattern.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.