Key Themes: Interest rate volatility, tariffs, market uncertainty, and hedging opportunities

Market Overview

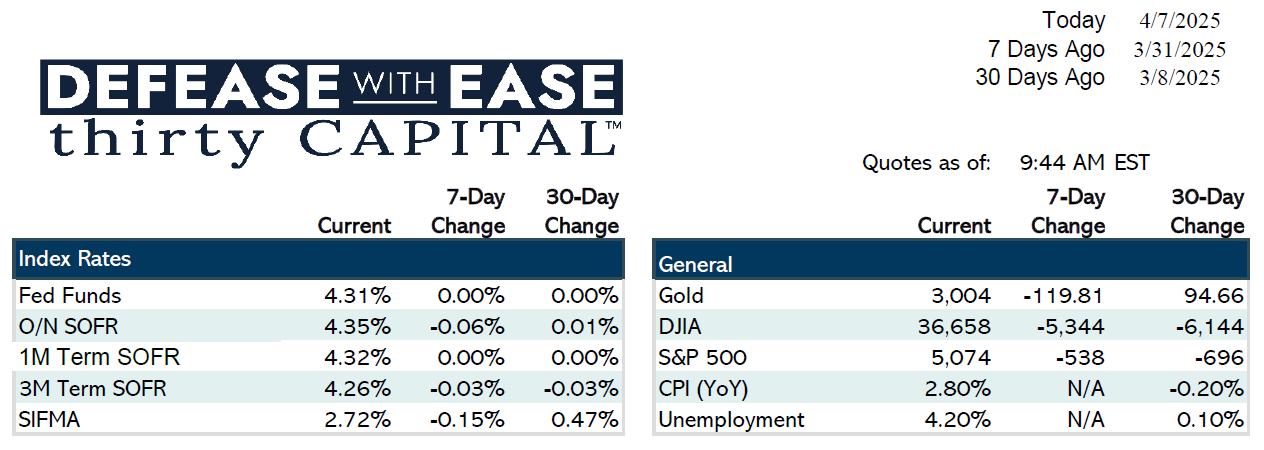

- Treasury yields declined sharply last week; 2- and 10-year swap rates both fell around 30 basis points.

- The gap between the 2-year yield and the Fed funds rate suggests it’s a good time to hedge interest rate exposure.

- Despite the rally, yields remain higher than they were before the Fed started rate cuts in late 2024.

Federal Reserve & Inflation

- The Fed remains focused on inflation, despite strong job numbers.

- The market is currently pricing in over four rate cuts for 2025.

- Nonfarm payrolls exceeded expectations at 228,000, reinforcing economic strength.

Tariffs & Policy

- Recent tariffs sparked recession concerns but have not yet significantly widened agency spreads.

- Tariff strategy is based on trade deficits rather than matching other countries’ rates, complicating negotiations.

- Dozens of countries are reportedly in talks over tariff resolutions.

- Tax extension debates continue, with a wide gap between Senate and House proposals.

Fixed Income & Hedging Strategy

- Clients are exploring hedging opportunities due to the drop in rates and ongoing uncertainty.

- Falling rates have increased prepayment penalties, impacting refinance decisions.

- There’s a push to take advantage of favorable market conditions before volatility increases further.

Looking Ahead

- Key Treasury auctions and economic data (including University of Michigan sentiment survey) are expected this week.

- Corporate earnings reports may offer more clarity on how businesses are reacting to tariffs.

- Ongoing political and economic uncertainty means conditions could shift rapidly.

Final Message

- Use current market conditions as an opportunity to de-risk portfolios.

- Lock in favorable hedges while they’re available—don’t try to time the market.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.