Things picked up last week with a flurry of key economic data and renewed rate volatility following a relatively quiet stretch. While GDP and consumer sentiment disappointed, job growth remained resilient—highlighted by Friday’s strong Nonfarm Payrolls report. All eyes now turn to the Fed’s upcoming FOMC meeting.

Last Week’s Highlights

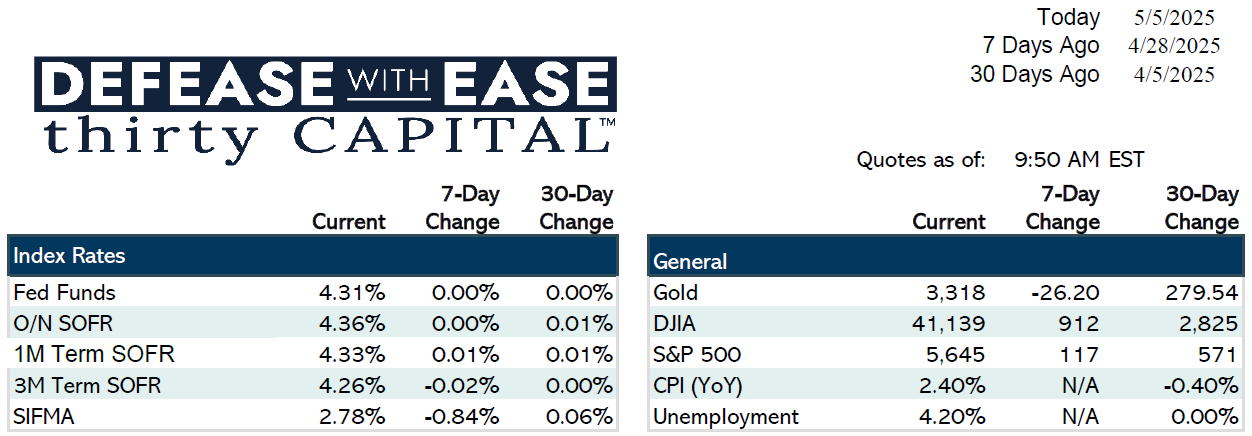

- Rates: The yield curve flattened with 2-year swaps rising 8 bps and 10-year swaps up 5 bps. Volatility spiked midweek.

- Economic Data:

- JOLTS and consumer confidence came in well below expectations.

- ADP employment report was soft at 62K, and GDP printed slightly negative (-0.03%).

- PCE inflation remained flat in March—better than expected on core.

- ISM manufacturing beat expectations (though still negative), and earnings momentum late in the week shifted sentiment.

- Friday’s NFP surprised to the upside with 177K new jobs, helping rates move higher into the weekend.

This Week’s Focus

- FOMC Meeting (Wednesday): The Fed is widely expected to hold steady, though market participants will closely monitor Chair Powell’s tone for any policy shifts. Despite sticky inflation, Fed Governor Waller signaled that the Fed would act quickly if economic conditions deteriorate.

- Treasury Auctions: $58B in 3-year notes (Monday), $25B in 10-years (Tuesday), and 30-year issuance Thursday.

- Market Expectations: Roughly 80–85 bps of cuts are still priced in for 2025, with Goldman projecting three cuts starting in July, while StoneX’s Catherine Rooney Vera sees just 50 bps of easing if inflation and unemployment move in the Fed’s preferred direction.

Fixed Income & Credit Markets

- Activity in bullet bonds remains muted, despite equities rallying ~15% since April lows.

- CMBS delinquencies hit 7% (the highest since 2021), driven largely by multifamily and hotel sectors.

Transaction Trends

- Deals are progressing slowly but still getting done, with delays often stemming from buyers or their financing partners rather than outright collapses.

- Retrades and wider spreads continue to pressure deal economics.

Takeaway

With macro uncertainty and rate swings dominating the narrative, market participants should prepare for hedging opportunities early in the week. The Fed’s guidance on Wednesday could set the tone for rates heading into summer.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.