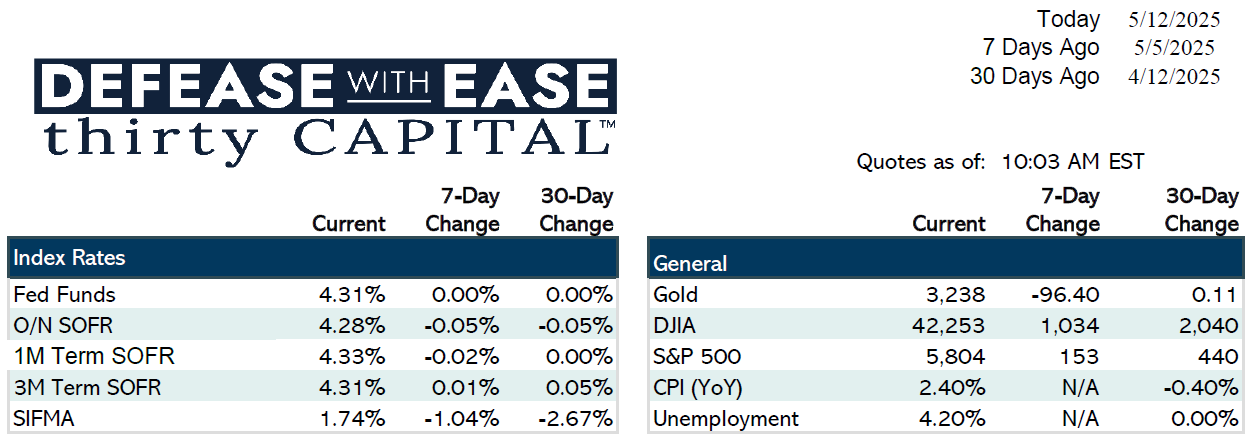

Markets were mixed last week, with strong services data and upbeat labor market indicators contrasting with the Fed’s cautious tone. Treasuries sold off into the weekend as optimism around US-China tariff talks gained traction. This week’s CPI and PPI reports will be key in shaping near-term rate expectations.

Last Week’s Highlights

Rates:

Treasuries sold off sharply late in the week, with yields rising 8–9 bps across the curve. The move was driven by tariff optimism and a rotation into equities.

Economic Data:

- ISM Services: Beat expectations at 51.6, showing modest growth in services activity.

- Jobless Claims: Came in strong at 228K, reinforcing labor market resilience.

- FOMC Meeting: Fed held steady, citing “uncertainty” as the dominant theme. Post-meeting rate cut expectations fell from ~81 bps to 55 bps for 2025.

Key Narrative:

Markets are adjusting to a more hawkish Fed outlook, with cuts being priced out amid sticky inflation and strong jobs data.

This Week’s Focus

- CPI (Tuesday): April inflation is expected at 0.3% MoM, 3.4% YoY headline; 2.8% core. A hot print could further reduce odds of rate cuts.

- Retail Sales & PPI (Thursday): Markets will assess consumer strength and upstream price pressures.

- Michigan Sentiment (Friday): Forecasted to improve slightly after months of soft readings.

- Treasury Auctions: Ongoing issuance could pressure long-end rates.

Fixed Income & Credit Markets

- Treasury traders faced continued volatility, with risk-on sentiment leading to further selling.

- Rate cuts remain priced in for 2025, but skepticism is growing about any 2024 action.

CRE & Transaction Trends

Sector Insights:

- Multifamily: Net absorption up 46% QoQ, but supply still outpaces demand. Vacancy at 8%.

- Retail: Strongest asset class with 2.6% vacancy, though absorption dropped 77% in Q1.

- Industrial: Slowing, with absorption down 42% YoY. Vacancy now 7%.

- Hotel: Occupancy at 63%, still below pre-COVID levels, but RevPAR has recovered.

- Office: Vacancy rose to 14%; still facing major headwinds despite back-to-office pushes.

Lender Activity & Alternatives:

- Traditional lenders remain cautious; credit and debt funds (e.g., Blackstone, Pimco, Brookfield) are stepping in to fill gaps.

- Over $1.1T in CRE maturities loom in 2025, with projected shortfalls as high as $570B.

Takeaway

Rate volatility and Fed hesitation continue to dominate the macro narrative. With inflation data due and political developments around tariffs and fiscal policy evolving, market participants should expect another choppy week. Hedge early if possible.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.