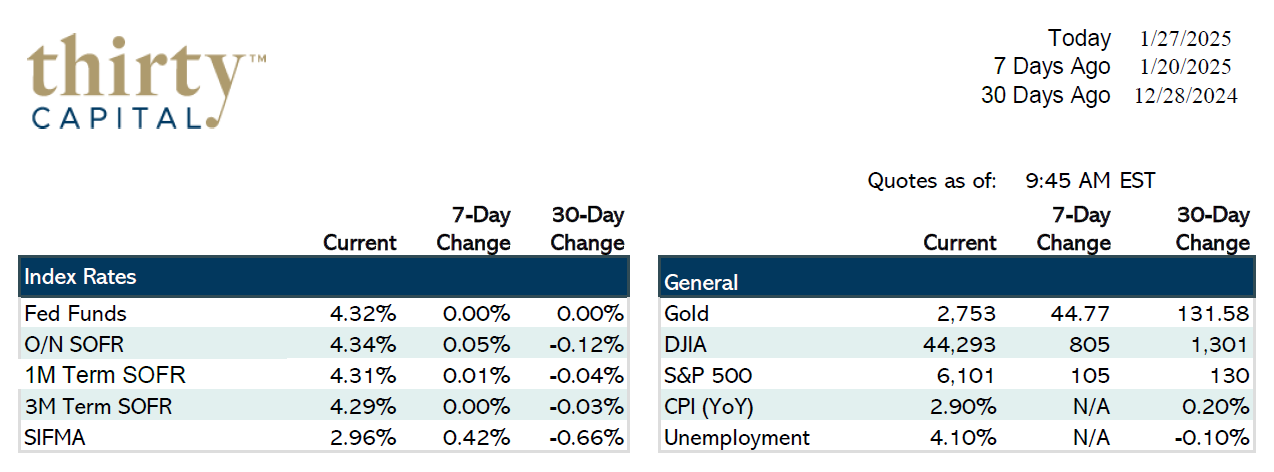

Last week was fairly quiet with limited rate movement throughout. The short end finished down about 3 BPS, and the 10-year came down only 1 point. Initial Jobless Claims were a bit soft and Manufacturing PMI relatively strong. There will be a lot more data points to watch this week, and we expect a lot of volatility along the way.

Rates are already down 10-12 BPS today due to a global tech sell-off. This rally has brought rates near where they were at the end of 2024. Today, $139B of 2-year and 5-year Treasurys will be auctioned off, and tomorrow $44B of 7-year Treasurys will be auctioned. There’s no chance whatsoever that the Fed will cut this week, but Powell’s speech following the FOMC meeting will be watched very closely for any “guidance” surrounding their cutting path. There are now two full cuts priced in for this year (one by June and another by EOY).

On Thursday we’ll get 4th quarter GDP figures. 2.7% growth is expected, which is slightly slowed from Q3 but still strong overall. On Friday, new PCE and Personal Income/Spending data will be released. Core PCE is expected to come in at 0.2%, which would be positive, and a softer number would get the Fed close to their inflation target.

CRE transaction volume is expected to tick up slightly in 2025, but it shouldn’t be a dramatic improvement YoY. Sponsors are particularly bullish on the retail sector right now, and low supply/high demand paired with higher rates may lead sponsors towards a more acquisition-heavy strategy with less development activity in the near term. Class C Multifamily deals are difficult, as they’re currently worth less than the debt on the property in many cases. Fannie & Freddie are pricing on top of each other right now, but floating rate spreads are coming in, and as a result, many sponsors will look to “right the ship” with shorter term debt.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.