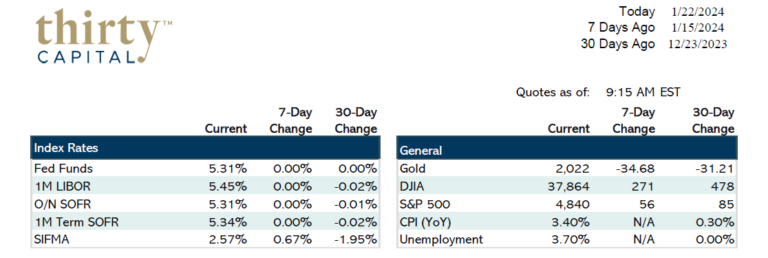

Last week we saw a lot of volatility with Treasuries. The 2-year yield and 10-year yield were up 24 and 18 BPS, respectively. The market has wiped one Fed cut off the table and is now pricing in 6 cuts instead of 7. On Thursday, Fed governor Waller spoke, stating that the Fed should lower rates “carefully and methodically,” which influenced market expectations.

Also on Thursday, retail sales figures came in higher than anticipated, which brought the 2-year yield up 14 BPS as a result. This accounted for the bulk of the week-over-week change. The market seems to be on edge, and any bit of news is causing movement.

This week GDP figures come out on Thursday and PCE data on Friday. PCE Deflator figures are always watched closely by the Fed and are considered their preferred measure of inflation. The trend seems to be that inflation is lowering, but rates could come back up in anticipation of the Fed slowing their cutting cycle.

Thirty Capital’s view remains that the market pricing in 6 cuts is aggressive. It’s still a great market for exercising forward-starting caps and hedges in general. The chance of a cut in March is down to 44.5%, and it’s now possible the Fed won’t take any definitive action until the May meeting. This could cause some upward pressure on rates as the market adjusts its expectations. A lot of big-time hedge funds are short on the 10-year, meaning they too anticipate long-term rates heading back up.

The big question is… even if the Fed starts cutting, does it save real estate? Cap rates will still price off the 10-year, and rate cuts likely won’t help bring long term rates down. They are more likely to take the inversion out of the curve, which won’t help valuations. How long can regional banks that are short on deposits extend?

Lastly, there are several Treasury auctions this week that will also be worth watching. Last week’s 20-year auction went historically poorly. There’s growing concern regarding who is investing in treasuries, given that our interest alone is now over $1 trillion annually. We’re running massive deficits, and it’s probable that President Biden will continue spending hand-over-fist before the election.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.