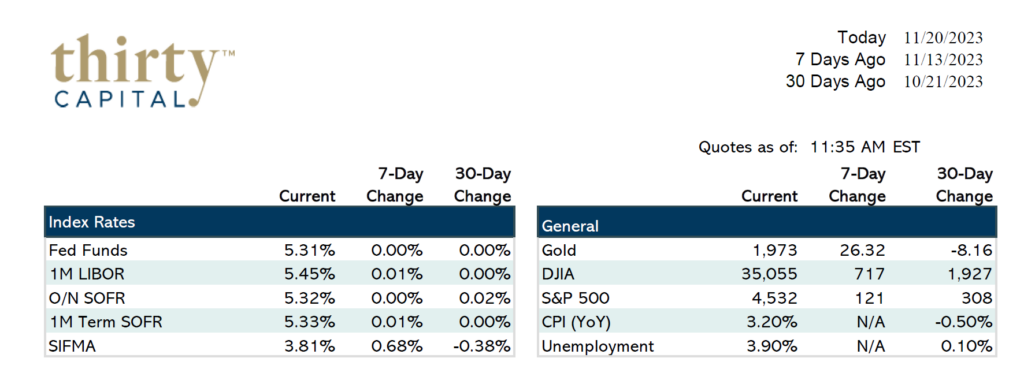

Last week we saw lots of volatility with Treasury yields. Short-term rates remained level with overnight SOFR sticking at 5.32, but there was a strong rally with Treasuries on the short end (down 19 BPS) after rates ran up the week prior. The Alternative Reference Rates Committee (ARRC), a committee formed by the Fed to process the demise of LIBOR, officially disbanded last week, and Bloomberg also announced they will no longer be publishing the credit-sensitive index BSBY.

Consumer price index (CPI) numbers were a bit softer than expected, which the market took as further justification for the Fed to pause rate hikes and possibly accelerate the timeline for rate cuts. Rates dropped almost 20 BPS on Tuesday following the release of CPI numbers. Producer Price Index (PPI) also came in soft behind CPI, and retail sales numbers were fairly strong as well.

With 100 BPS of cuts built into the curve for next year, there are still great opportunities to execute forward starting caps & swaps.

This week will be very quiet with Thanksgiving. Markets are open Wednesday but closed Thursday and for half of the day on Friday. The most important piece of economic news to watch this week will be the minutes from last month’s Federal Open Market Committee (FOMC) meeting.

On more of a Macro level, the House passed a temporary bill to avoid a government shutdown. More fights & disagreements are anticipated to come in January.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.