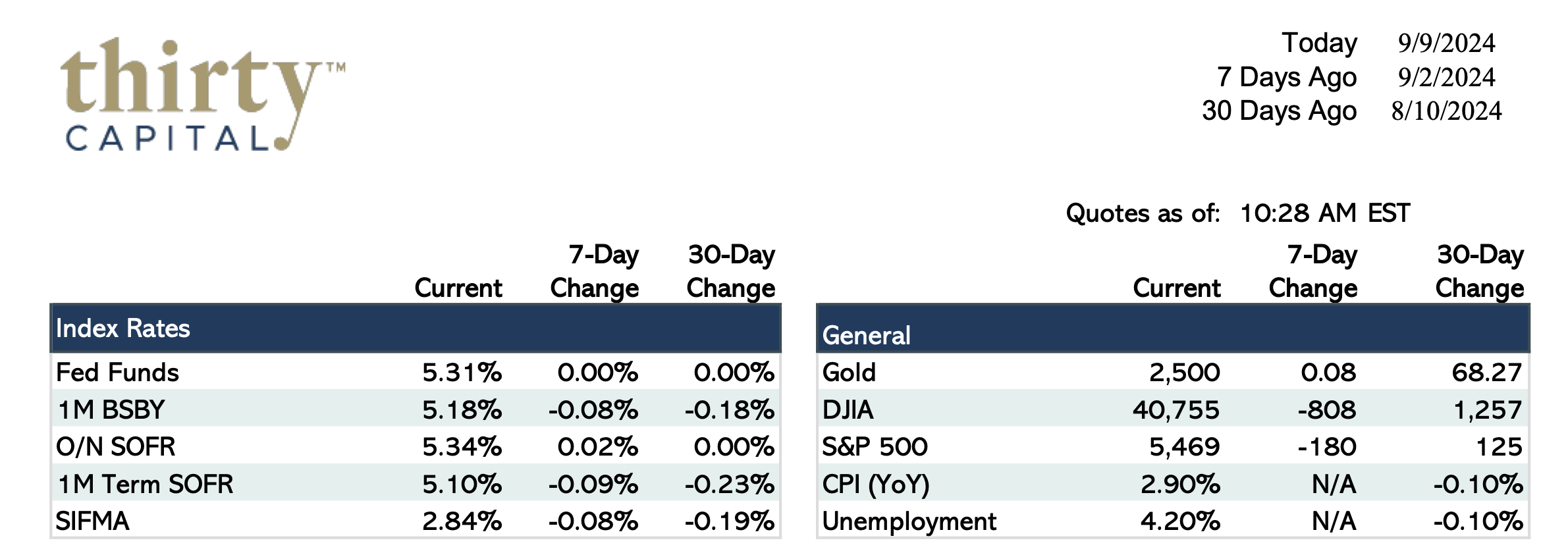

Last week was a short one with Labor Day on Monday, but it was eventful, nonetheless. The 2-year SOFR Swap rate finished at 3.44%, which was a 28 BPS decrease. 10-year Swaps finished at 3.25%, which is a 1-year low. On the Treasury curve, 2’s to 10’s “un-inverted” last week. Swaps trade as a spread to Treasuries and 2’s to 10’s remains slightly inverted.

JOLTS numbers came in very soft on Wednesday, about 300k below the previous figure and well below the surveyed number, which served as further evidence the job markets are slowing. Durable Goods and Factory Orders came in on top of their targets, and ISM numbers were reasonably strong and on-target as well. On Friday, Nonfarm Payroll came in below expectations, and we saw big downward revisions for the prior two months. The unemployment rate remained steady at 4.2%.

While last week was about jobs, this week will be about inflation. We’ll get CPI figures on Wednesday followed by PPI on Thursday. Both MoM figures are expected to soften slightly. There will also be three Treasury auctions worth watching this week (3-year on Tuesday, 10-year on Wednesday, 30-year on Thursday).

The market is pricing in 4-5 cuts through the remainder of 2024, meaning cuts of 50 BPS are expected. The jobs market has not softened enough for the Fed to start slashing rates. This would counter what the Fed has said it wants to do and what may be seen as productive. We think the market is overestimating, and it remains a good time to roll interest rate hedges forward. With rates moving more quickly than spreads, it may be a good time to lock in fixed rates as well.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.