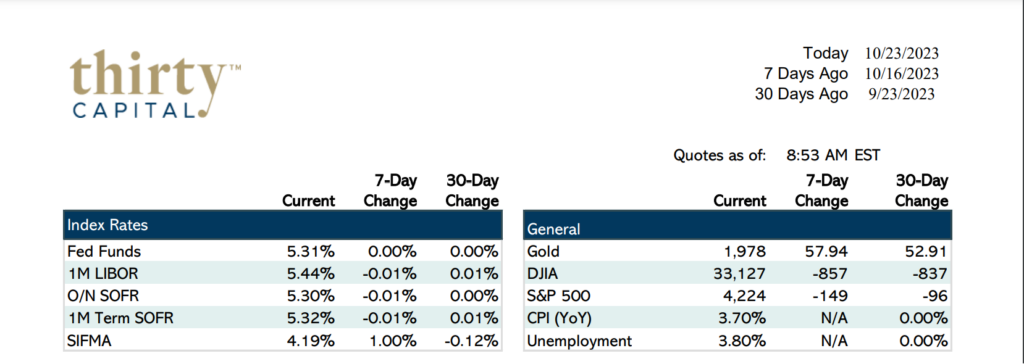

To recap the Thirty Capital Monday Morning Market Call: The recent attention on the 10-year yield surpassing the 5% threshold, not seen since 2007, is noteworthy. This development has sparked discussions about the threshold’s relevance in today’s market dynamics. Many believe that the 5% mark isn’t the ultimate resistance, anticipating even higher levels in the near future. Some speculate this could usher in a wave of market buyers, while others see a potential for the yield curve to flatten further.

Several factors are fueling this surge in rates including:

- Quantitative tightening

- Concerns about escalating government debt in relation to deficits

- Evolving yield curve, currently steepening, which suggests market anticipations

Some experts suggest a flattening yield curve might imply market expectations to stave off a recession, given the Fed’s “higher for longer” stance.

Investors and analysts are eagerly awaiting forthcoming GDP and Personal Consumption Expenditure data releases later this week. Robust GDP growth expectations and prevailing concerns about inflation remain at the heart of market sentiment. While the market seems to anticipate no imminent rate hikes, notably for November, all eyes will be on how new economic data could influence these probabilities.

There were also brief discussions on corporate matters, particularly the Rite Aid bankruptcy announcement. Rite Aid’s strategy to shutter some outlets and renegotiate leases has ignited interest, prompting questions about its ripple effect on the commercial real estate sector. Conversations also encompassed AAA corporate bond spreads and their implications for the broader financial arena. Rising yields and their potential impact on the stock market were debated, with some speculating that if yields climb beyond certain points, like 5.3%, it might sway retail investors to exit the stock market, potentially triggering a downturn.

On the political landscape, ongoing issues in the Middle East and Congress’s deadlock on appointing a new speaker add layers of market uncertainty. Yet, despite the multifaceted challenges, there’s a prevailing sentiment of cautious optimism among market participants. The trajectory of interest rates, inflation trends, and key economic data releases will invariably shape market sentiment and dictate investment strategies.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.