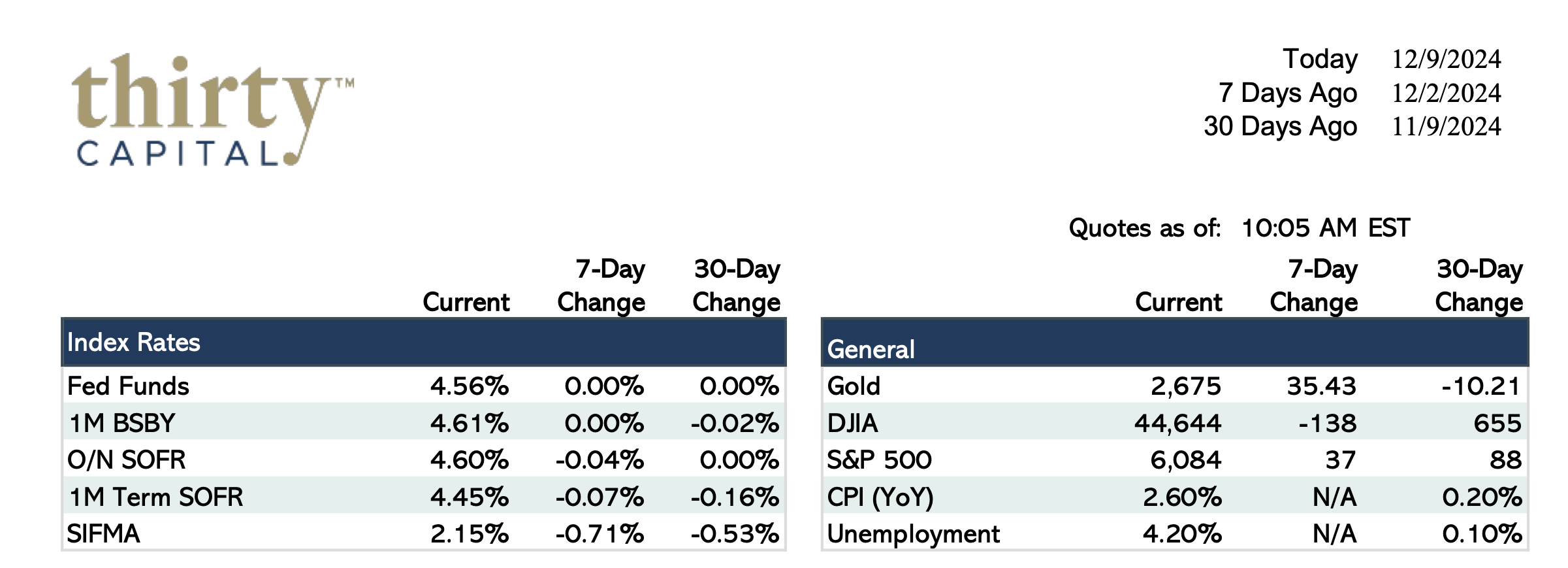

Last week rates continued the downward trend, with 2’s and 10’s now roughly 25 BPS off their highs. Overnight SOFR is still at 4.60, but with an 85% chance of a rate cut next month, 1M Term SOFR is trading at 4.45% (since it’s a forward-looking index). Last week was all about jobs on the economic data front, and the takeaway is that the US economy is still doing well. We saw a significant uptick in job openings with new JOLTS data. ISM Manufacturing data was stronger than expected, and ISM Services was lighter than expected but still strong overall. Nonfarm Payroll came in mostly as expected, and there were revisions up on prior releases. Unemployment came out slightly higher than expected.

This week we have 3-year, 10-year and 30-year Treasury auctions. Demand for each will be monitored closely. We get CPI data Wednesday, which is expected to tick higher by 0.1%. PPI will follow Thursday. These are important releases given they’re the last inflation readings before the next Fed decision. The markets seem to be more in line with the Fed than they were previously, when a lot of cuts were being priced in. There’s an 85% chance of a cut next week, and 3.5 in total are expected by the end of 2025.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.