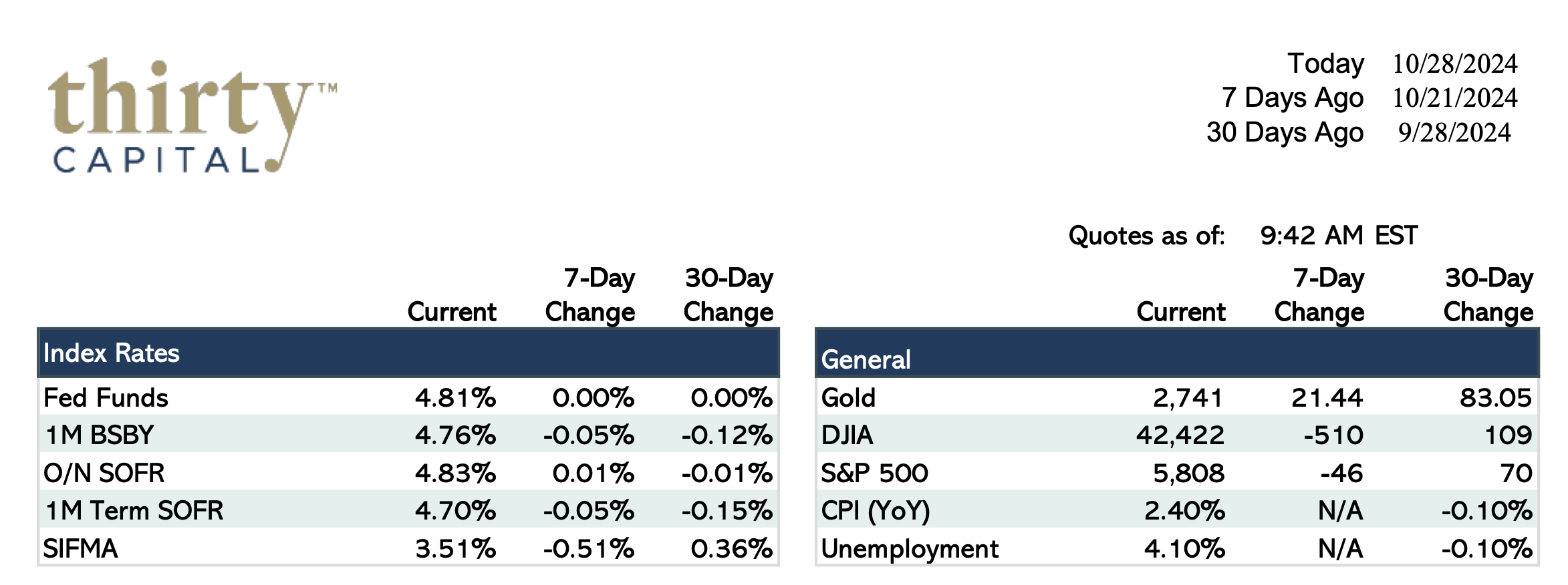

Last week was quiet in terms of new economic data but not so much with rate movement. 2-year Swaps came up 14 BPS, and 10-year Swaps rose 15 BPS. The 2-year Swap rate is now nearly 60 BPS higher than where it was immediately following the Fed’s 1st cut of 50 BPS. Overnight SOFR has stayed consistent at 4.83%, and 1M Term SOFR is at 4.7%, with markets assuming a 96% chance of a 25 BPS cut on 11/7.

This week will be a critical one for new economic data. $144B of US Treasurys will be auctioned off today, between 2’s and 5’s. JOLTS data comes out tomorrow, with a decrease in job openings expected. GDP is expected to stay consistent at 3% Wednesday, and Thursday we get Personal Income/Spending data as well as PCE. Core PCE is expected to tick up slightly on a MoM basis and tick down slightly YoY. Friday we will get monthly jobs data, and of course the election is next week.

Could the results of the election change the direction of rates? It may be too early to tell. Both sides have inflationary policy so the landscape may not change drastically. This week’s data could potentially decrease the chance of a December cut, but all signs seem to point to a 25 BPS cut on 11/7. With central banks electing to cut all over the world, the FOMC will likely follow suit.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.