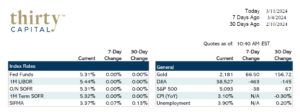

Last week, we saw the 2-year & 10-year Treasury yields drop 6 and 11 BPS, respectively. It was a mostly uneventful week, which is surprising given all the new data and Fed speak. On Thursday, Chairman Powell gave his semi-annual congressional testimony, reiterating that they aren’t in a hurry to cut rates and that the decision remains data-driven. This lack of new rhetoric was reflected in the market. On Friday, nonfarm payroll numbers came in at 275k, versus an expected 200k gain. However, the prior two months were revised down 167k total, and unemployment ticked up to 3.9%. Rates dropped following this news.

This week, we have CPI numbers to watch for on Tuesday, followed by Retail Sales and PPI on Wednesday. If CPI numbers come in hotter than expected, rates could move up violently. Following the last CPI release, short-term rates jumped up almost 30 BPS over the few weeks that followed. For this reason, the latest figures will be watched closely.

NYCB raised $1B of equity, and the stock is trading in the 3’s. It’s not fully recovered, but the chance of a failure for the bank is now looking slim.

The market priced in another half cut last week, with softer than expected economic data (ISM in particular). Payroll numbers remain very strong. The Fed will not be cutting this month and almost certainly not in May. The market seems to be going back and forth between June and July for the first cut.

Some of the benefit for forward starting caps has diminished, but it remains a cheaper option than spot starting. Low strike caps are considerably cheaper on a forward basis since there’s a lesser Vol surface component. Higher strike caps are currently not much cheaper on a forward basis, due to significant Vol.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.