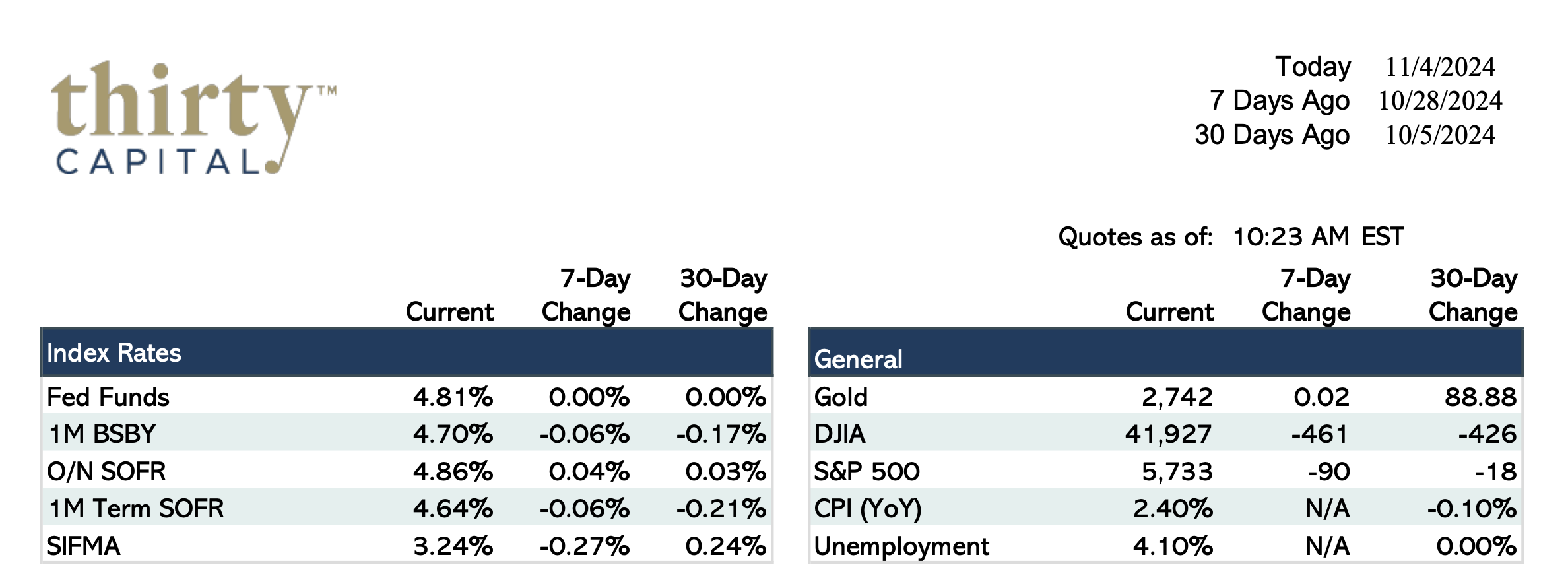

Term SOFR is currently sitting at 4.64% (22 BPS below Overnight SOFR), which is reflective of the upcoming Fed meeting, given there’s a 98.5% chance of a 25 BPS cut. Term rates are up across the board, with 2’s/10’s up about 10 BPS WoW. Demand was soft for last week’s TSY auctions. This week $125B of 3’s, 10’s, and 30’s will be auctioned off. With rates moving up, these will be very interesting to watch.

JOLTS numbers came in soft early last week (7.433MM vs 8MM surveyed), which was a big drop from the prior reading. GDP came in slightly soft on Wednesday (2.8% vs 2.9% expected – a very minor miss). Inflation data on Thursday (PCE) came in slightly high, particularly Core PCE YoY, but overall, mostly as expected. The big miss of the week was Nonfarm Payroll, which came in at 12k compared to the surveyed number of 100k. However, a lot of folks are discounting the release given the hurricane, strikes, etc. All in all, the week was a mixed bag but yields marched higher.

This week is, of course, all about the election tomorrow & the FOMC meeting on Thursday. We are expecting a lot of volatility. Predictive markets seem to be favoring Trump, but both Agendas are inflationary. Rates on the longer part of the curve are likely to go up either way.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.