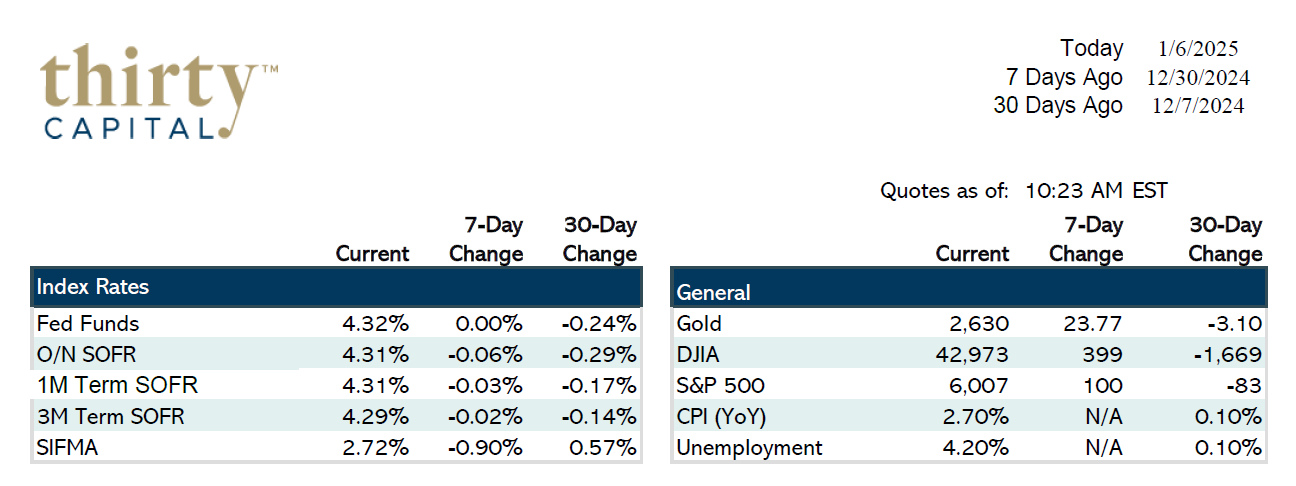

Last week started with a bit of a rally off the recent highs, but it didn’t hold up for long. Initial Jobless Claims reached an 8-month low on Tuesday, indicating continued strength in the jobs market, and Friday’s ISM Manufacturing numbers were stronger than anticipated at 49.3, which is on the verge of being expansive. Speaker Johnson was re-elected Friday, which gave back most of the initial rally, and we closed the week roughly 3-4 BPS down across the curve.

Since September 18th, the Fed has cut 100 BPS, and Overnight SOFR has dropped from 5.33% to 4.31%. This is significant relief for any borrowers floating unhedged. Over the same period, 2-year Swap rates are up about 70 BPS, and 10-year Swaps are up 84 BPS. It’s reasonable to expect the curve to continue steepening in 2025.

There’s a lot of concern surrounding the vast amount of Treasuries being auctioned off. We have 3-year, 10-year, and 30-year TSY auctions this week. If one or multiple of them are received poorly, rates could move up more. If the economy trips up this year, the Fed may have more room to cut. This week, we also get JOLTS and ISM Services on Tuesday, Fed minutes Wednesday, and Payrolls on Friday (expected +160k).

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.