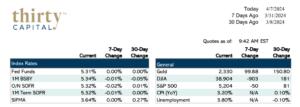

Last week, 2-year and 10-year Treasury yields rose 13 and 20 BPS, respectively. Bloomberg’s World Interest Rate Probabilities model now predicts 2 rate cuts with a 50/50 chance of a 3rd by 12/18. The market seems to be getting back to the “higher for longer” stance (or at least closer to it).

There was another big selloff last week, and 2-year Swap rates rose to the highest levels since November of last year, before the market began pricing in upwards of 6 cuts. ISM services numbers came in relatively light Monday, but we had the first expansionary manufacturing numbers since October of 2022.

Friday’s nonfarm Payroll release was a blowout, coming in at 303,000 vs. 214,000 expected. Economists will tell you the Fed is more focused on inflation than jobs, but employment numbers like this may also discourage the Fed from cutting rates quickly.

This week’s focus will be on inflation data. CPI on Wednesday is expected to increase by 0.3%, but there’s a lot of talk about this figure coming in hotter than expected. The PPI release will follow on Thursday. Both data points will be very telling about rates and the anticipation of cuts.

There’s a very bearish tone in the Treasury markets with rate cuts getting priced out, heavy TSY issuance continuing, oil prices going up, and political turmoil not improving in the Middle East & Russia. Another round of elevated CPI/PPI figures could keep moving rates up, and we already blew through what we believed to be resistance levels for the 2’s & 10’s last week.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.