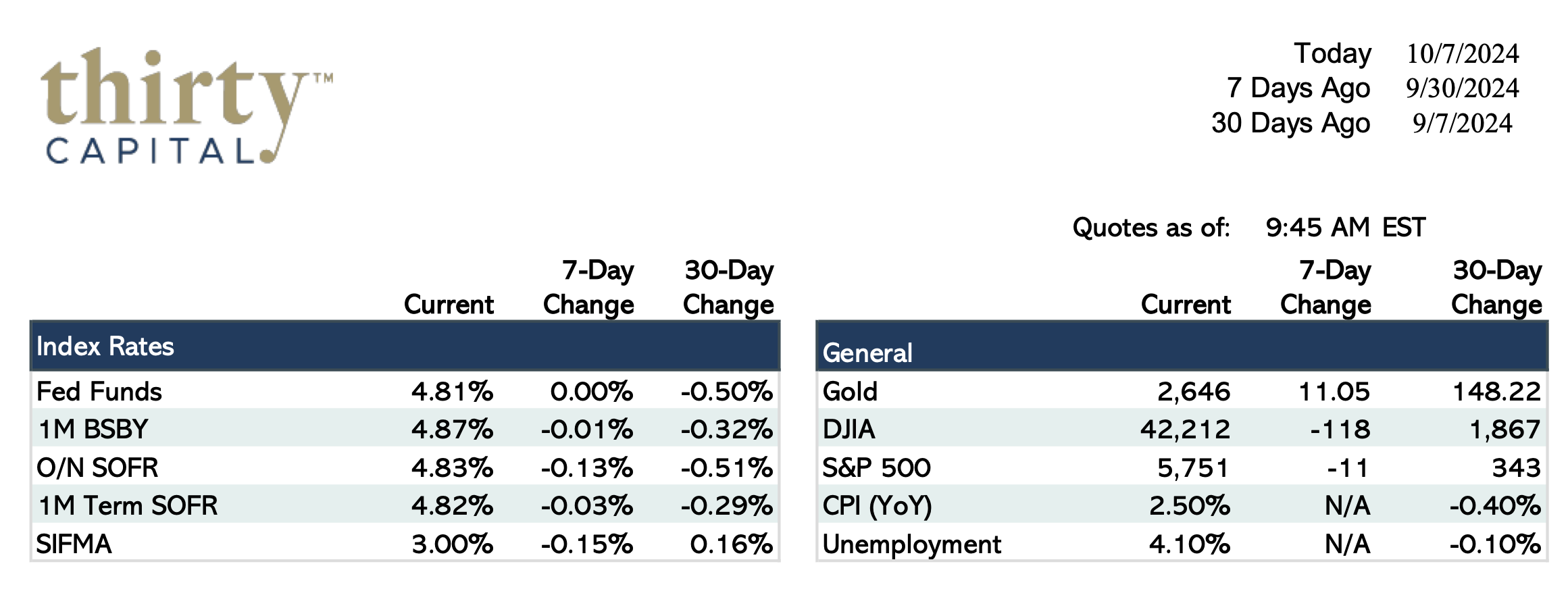

Last week was all about jobs. JOLTS numbers came in significantly better than expected on Tuesday (nearly half a million higher than the number surveyed), and ISM Services came in strong at 54.9 on Thursday. ISM Manufacturing numbers came in soft. Friday’s Nonfarm Payroll release came in at 254k vs. 150k expected, with 72k in revisions for the prior month as well. Unemployment moved down to 4.1%, which was unexpected. 2-year Swaps closed the week at 3.73% (37 BPS higher), and 10-year Swaps closed at 3.50% (20 BPS higher). Most of this movement came on Friday in response to Nonfarm Payroll & Unemployment data. There are now fewer than two rate cuts priced in for 2024 according to Bloomberg’s World Interest Rate Probabilities, and there’s even a slim chance they don’t cut at all during their next two meetings.

Employment is seemingly stronger than expected, and this week the focus is back to inflation, with CPI coming out Thursday and PPI on Friday. MoM improvements are expected in both cases (0.2% to 0.1%). We also have 3-year, 10-year, and 30-year TSY Auctions to watch on Tuesday, Wednesday, and Thursday respectively. Continued Fed speak is also worth watching this week.

Freddie Mac held their capital markets conference last week and is expecting higher volume / better supply for their securitizations moving forward. 5-year deals remain popular, but demand for 7+ year deals is improving as well. Insurance premiums for Multifamily are improving but are still much greater that they were before COVID.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.