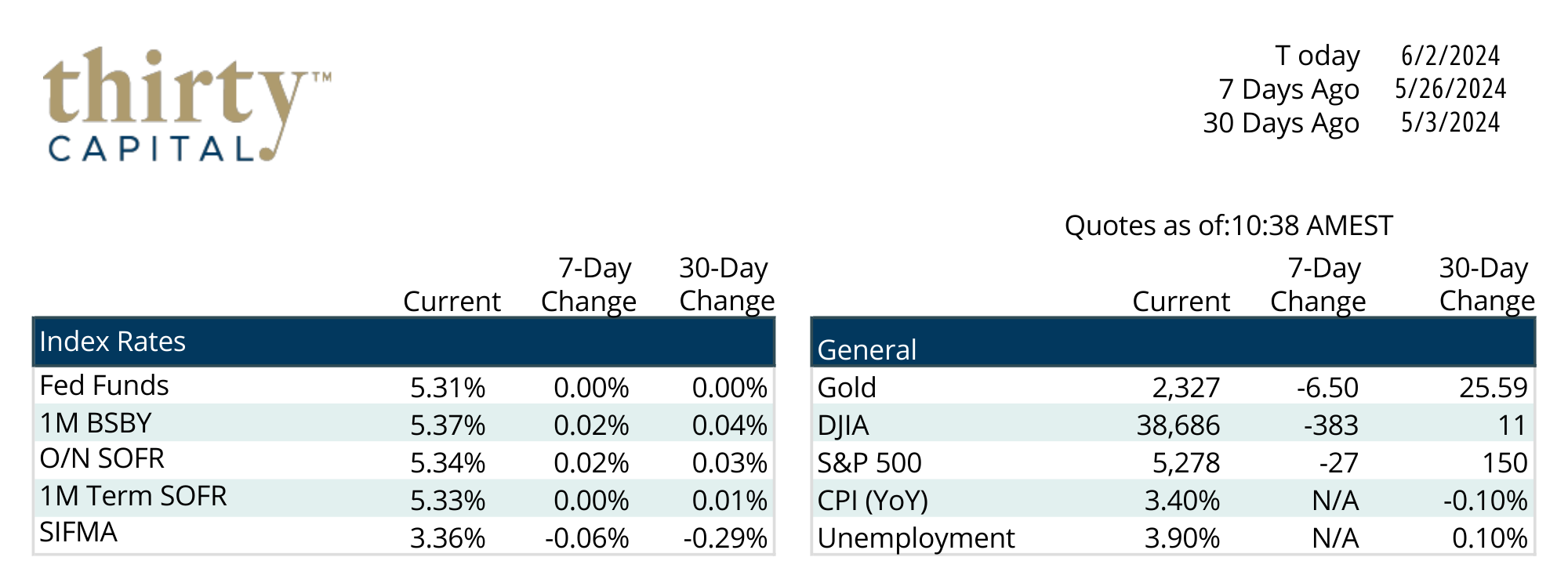

Last week, we saw further steepening of the yield curve. Short-term rates shot up at the beginning of the week, with the 2-year Treasury hitting nearly 5%. However, short-term rates rallied Thursday & Friday, showing we might be range-bound despite lots of intra-week movement. The 10-year Treasury yield moved up on the week, with about 10 BPS of steepening total.

Thursday, we saw the Personal Consumption Index numbers revised down more so than expected, which supports a softening economy. PCE figures on Friday came in more elevated than the Fed would like, but the market took it very well due to concern that the data would come in much higher than expected. The Fed will keep rates elevated until we see evidence that we’re returning to an annual PCE number of 2%. For this to happen, monthly PCE numbers will need to come in with a 1 handle.

Today, we’ll get ISM Manufacturing numbers, & ISC Services data comes out on Wednesday. JOLTS numbers will be watched tomorrow, but Nonfarm Payroll on Friday will be the big release this week. Commentary from bank economists suggests we might get a higher payroll number than expected, which could be significant with the Fed meeting coming up next week.

The upcoming wall of maturities is beginning to drive some activity with existing floating rate deals. May was busy with modifications and extensions, but trading activity for new deals still remained limited.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.