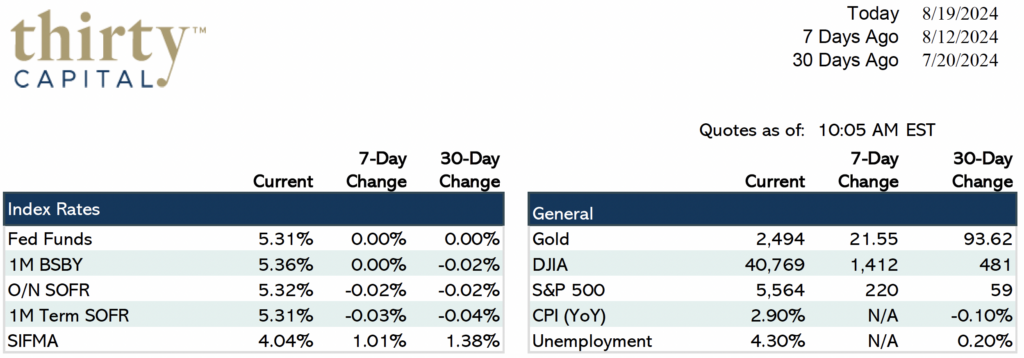

Last week, 2-year Swaps came down only 1 basis point, while 10-year Swaps came down 5 BPS to 3.34%. There was more intra-week volatility than these modest dips suggest. PPI came in slightly soft but largely as expected, and CPI came in right as expected at 3.2% YoY. This is still well above the Fed’s target of 2%. Thursday, Retail Sales data blew the doors off, coming in at 1% MoM vs. the surveyed number of 0.4%. For reference, the prior reading was -0.2%. Weekly jobless claims came in modestly at 227,000, which is well below the 4-week rolling average. This led some investors to believe a soft landing still may be possible.

I may sound like a broken record here, but there remains a tremendous opportunity to execute forward starting hedges within 18 months. With about 95 BPS of cuts priced in this year and eight total cuts by the end of 2025, we advise you roll trades forward while you can. We maintain that the market is overly aggressive on eight cuts, considering a 3.2% CPI reading is well above the Fed’s target.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.