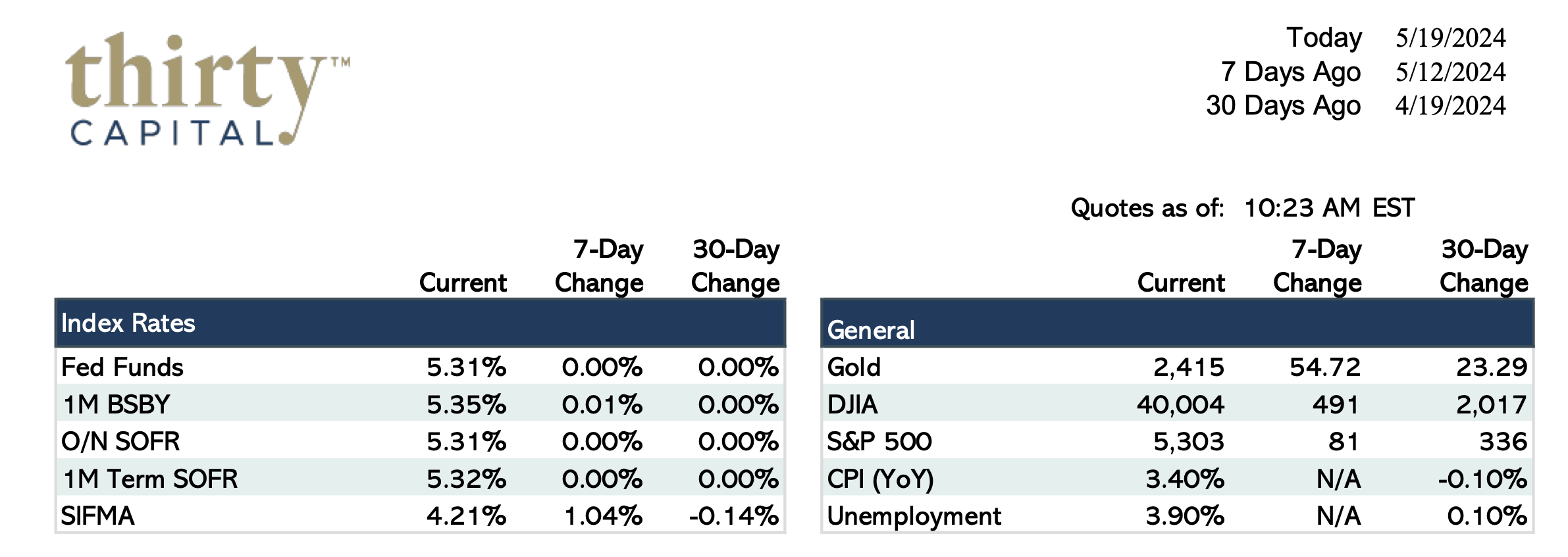

Last week we saw further inversion in the yield curve with 2-year swap rates coming down 5 bps and 10-yr swap rates down 7 bps. We’ve now recognized two years of an inverted curve, with expectations around the first rate cut continuing to circle for the September/November fed meetings. Discussions around whether Europe/England may front run the US in cutting rates are starting to emerge, but this will be tough to forecast with the level of influence US monetary policy holds across the globe.

CPI and PPI came in less than impressive last week, with rates dropping in response to this on Wednesday. Weak retail sales numbers exacerbated this drop, with Fed speak remaining mostly hawkish.

This week will be somewhat quiet on the macro front. Wednesday’s Fed minutes will likely drive rate movement along with Durable Goods data coming out on Friday, but the coming holiday should provide stability leading into Friday’s early market close.

There has been a continued trend of all cash buyers in the market, while rate buydowns remain prevalent on new financing. On 5–7-year terms, we’re seeing 25 BPS buydowns for a 1% cost, with this falling closer to 14 BPS on 10 year deals.

On a macro level, the fed will start tapering their quantitative tightening in June. There is little certainty over the direct impact this will have on rates, but the hope is that market demand will be eased as a result.

About Thirty Capital Financial:

Thirty Capital Financial is a leading service provider to the commercial real estate industry. Our team of advisors have spent decades providing solutions for defeasance, interest rate hedging, and debt management. With our personalized approach, we provide you with the tools, solutions, and strategies to confidently manage debt while supporting the growth of your company. Contact us today to speak with an expert defeasance consultant!

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.