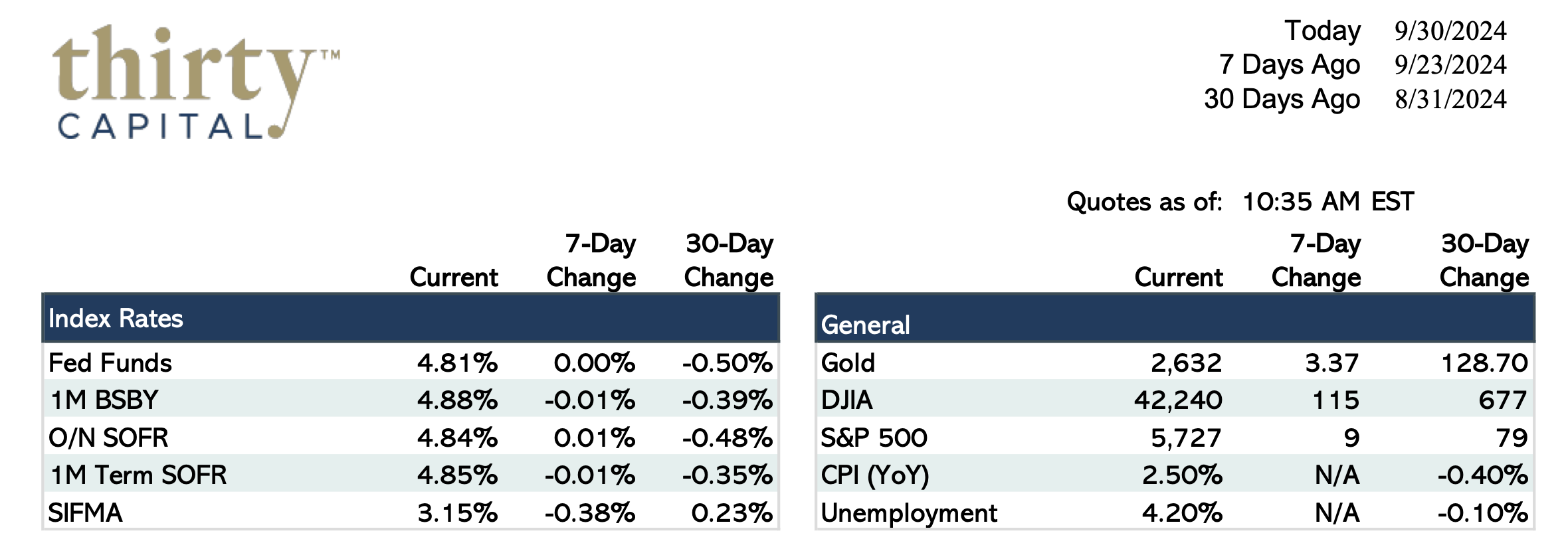

Rates were choppy last week but finished the week mostly flat. 10-year Swaps finished the week level, and 2-year Swaps dropped 3 BPS. 1M Term SOFR is at 4.85% but should begin to tick lower during the latter part of next week. Consumer Confidence came out much lower than expected on Tuesday (98.7 vs. 105 the month prior). Durable Goods came in flat on Thursday, which exceeded expectations. Initial Jobless Claims also exceeded the surveyed number on Thursday, and MoM PCE softened very slightly. University of Michigan’s inflationary projections were pretty consistent with the Fed’s, suggesting most of the movement with 2-year rates may be behind us.

The focus is back to jobs this week, with JOLTS kicking things off tomorrow. We’ll get ISM numbers on Thursday and Nonfarm Payroll data on Friday. Unemployment is expected to remain flat at 4.2%. Powell is speaking in Tennessee today, where he should give some guidance on the Fed roadmap. The general inclination is that the Fed will not be as aggressive as many think; however, we are likely in ‘wait and see’ mode for the time being.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.