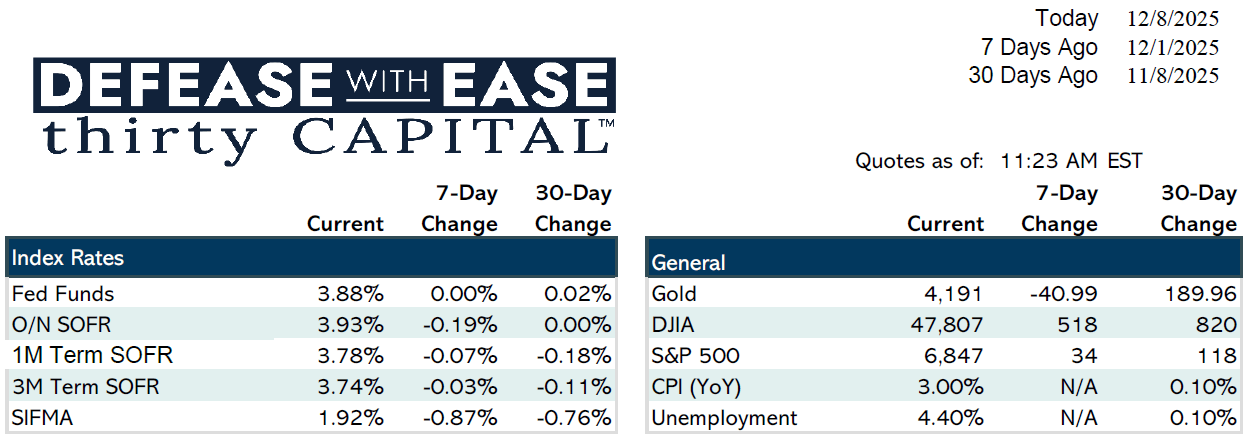

Markets pulled back last week as stronger labor data and mixed manufacturing readings pushed yields higher across the curve. Overnight SOFR eased to 3.93%, with one-month SOFR at 3.78 but tightening.

ISM manufacturing showed deeper contraction while prices paid jumped sharply, signaling lingering inflation pressures. ISM services moved the opposite direction, expanding with easing prices. Labor data remained mixed, with weak ADP payrolls but stronger-than-expected jobless claims. Despite this, futures still price in a 25 bp cut next week, though expectations for 2025 have shifted more hawkish, with markets seeing the next move potentially not until spring or early summer.

Curves steepened modestly, and short-end funding remains tight. The Fed is reportedly considering a short-term liquidity facility to stabilize repo and SOFR markets heading into year-end.

With one final cut expected and liquidity set to thin out, the next two weeks offer the last clean window for borrowers to execute trades before the holiday slowdown. Historically, rates have risen following recent Fed cuts, a risk to keep in mind.

On the agency side, liquidity remains stable, repo is trading near 4%, and dealers are beginning to lighten post-year-end balance sheets. Politically, no material developments are expected to affect rates, and while smaller banks face some stress, broad systemic risk appears limited. Future cuts would ease pressure further.

Looking ahead, all focus is on this week’s Fed meeting. The cut is priced in, but the tone and forward guidance will dictate rate direction through early 2026. Labor market strength remains the key swing factor.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.