Markets rallied last week as weak labor data strengthened expectations for Fed easing. Nonfarm payrolls added just 22,000 jobs vs. 75,000 expected, pushing unemployment up to 4.3%. Softer JOLTS and jobless claims data reinforced signs of a cooling labor market.

Rates moved lower, with the 2-year Treasury hitting a 3-year low and the 10-year swap falling 15 bps. Futures now price in a near certainty of a September cut, with about three cuts expected by year-end and up to six by 2026. A 50 bp move remains possible if this week’s CPI and PPI prints come in soft.

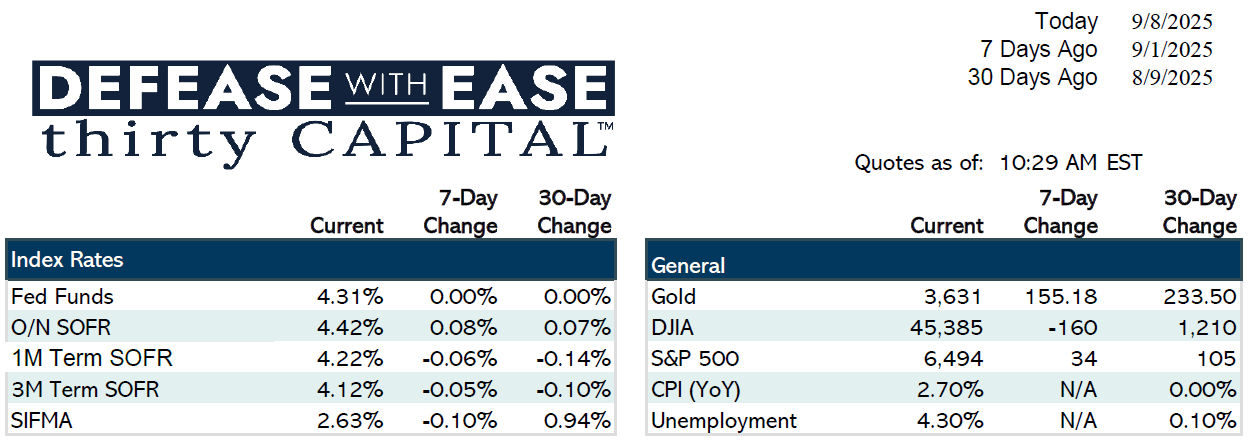

Short-term funding markets showed some stress, with overnight SOFR elevated around 4.42% while one-month SOFR trades lower at 4.22%. Repo pressure is contributing to the divergence.

In real estate, oversupply in multifamily markets is leading to rising concessions and vacancies, making refinancing difficult. Borrowers are favoring shorter bridge debt and caps, while agency callable issuance remains heavy.

This week’s focus is on CPI, PPI, and Treasury auctions ($119B in supply). Unless inflation surprises to the upside, a September rate cut looks all but certain.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.