Market Volatility Prompts Caution as Interest Rates Swing and Sentiment Sinks

In this week’s Monday morning market call, analysts painted a picture of continued volatility across financial markets, driven by economic uncertainty, geopolitical tensions, and fluctuating inflation data.

Key Highlights:

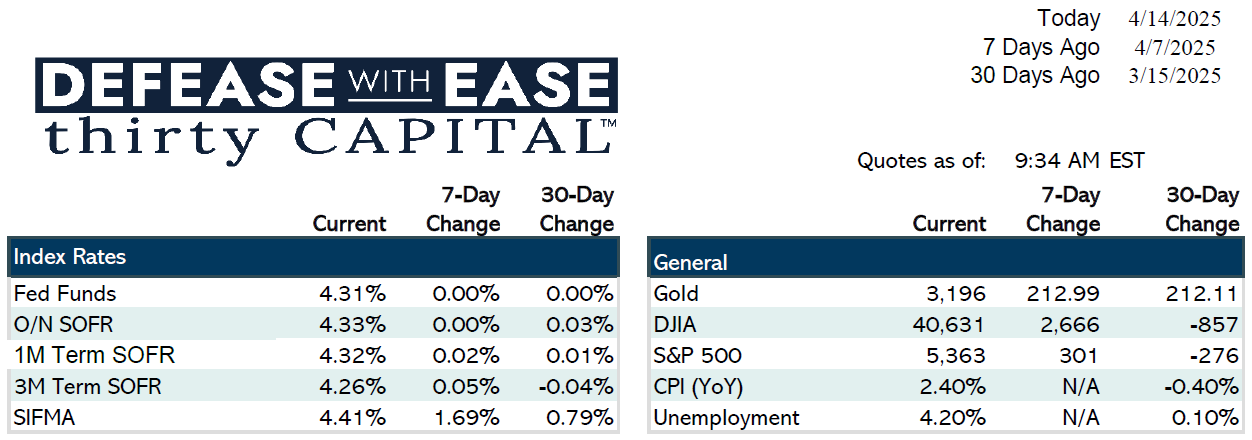

- High Volatility Across Markets: Equity and bond markets have seen significant sell-offs, with the 10-year Treasury yield rising by 50 basis points and swap spreads narrowing—signaling increased pressure on liquidity.

- Inflation Below Expectations: Recent CPI and PPI reports came in below forecasts, but surprisingly failed to calm markets. Instead, yields continued to rise, suggesting investors are more focused on broader macro risks and Fed signals.

- Deteriorating Sentiment: The University of Michigan’s consumer sentiment index dropped to 50.8—levels not seen since the height of the COVID-19 pandemic—adding to the market’s bearish tone.

- Advice for Borrowers: Experts recommend that borrowers hedge their interest rate exposure and maintain flexibility with lenders amid rising uncertainty and transactional slowdown.

- Liquidity Still Stable: Despite the volatility, no major liquidity crises have emerged. Trading remains functional, though slower than usual.

- Bank Lending Activity Rising: Banks are deploying more capital, thanks to recent rollbacks in Basel capital requirements. Short-term floating-rate loans are currently popular as a bridge strategy until conditions stabilize.

Outlook:

The team expects continued market volatility in the coming weeks. With risk assets widening and geopolitical tensions simmering, staying nimble and proactive in hedging strategies is strongly encouraged.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.