Key Takeaways:

-

Market Recap

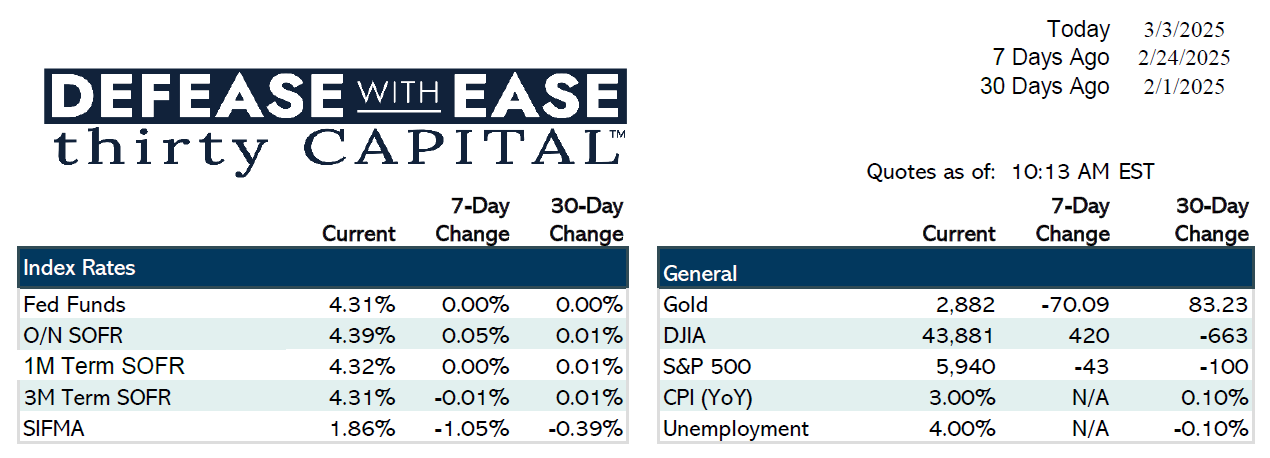

- Last week saw a strong rally across the yield curve, with 2-year swaps closing at 3.84% (down 20 basis points) and 10-year swaps at 3.79% (down 25 basis points).

- A significant drop in consumer confidence, particularly from the University of Michigan and Conference Board reports, contributed to falling rates.

- Treasury yields reacted to economic uncertainty, with increased market volatility.

-

Economic Indicators & Fed Outlook

- Upcoming Reports: ISM Manufacturing (Monday), ADP Employment (Wednesday), and Non-Farm Payroll (Friday).

- Market sentiment suggests concerns over economic and labor market softening.

- The Fed’s anticipated rate-cutting cycle is already being priced into the market, with about 65 basis points of cuts expected in 2025.

- The European Central Bank (ECB) is also expected to cut rates this week, reinforcing the global rate-cutting trend.

-

Market Strategy

- Be Prepared to Act: Volatility remains high, with frequent 10+ basis point daily moves in Treasury yields.

- Positioning for Opportunities: Investors should ensure documentation and onboarding are in place to execute trades when favorable conditions arise. And if you’re planning to refinance or secure new debt, watching the market’s movement (rather than just the Fed’s announcements) can help you lock in a lower rate earlier.

- Fixed Income Trends: Investors continue favoring short-term fixed rates (5-year full I/O loans) with rate buy-downs bringing rates to mid-to-high 5% levels.

- Be Proactive: Because market rates tend to move ahead of official policy, waiting until the central bank formally cuts rates can mean missing out on the most advantageous borrowing costs.

-

Looking Ahead

- Trump’s Speech to Congress on Tuesday could influence markets, particularly regarding tariffs and economic policies.

- Continued focus on employment data and rate movements.

Final Thoughts:

- We’re starting to see rates drifting lower, which could signal another cutting cycle. This means borrowers might want to take action sooner rather than later, before official cuts are announced and the best opportunities have already passed.

- Market conditions remain highly volatile, and rate movements are increasingly influenced by economic data, Fed expectations, and global central bank policies.

- Investors should stay ready to execute trades as market opportunities arise.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.