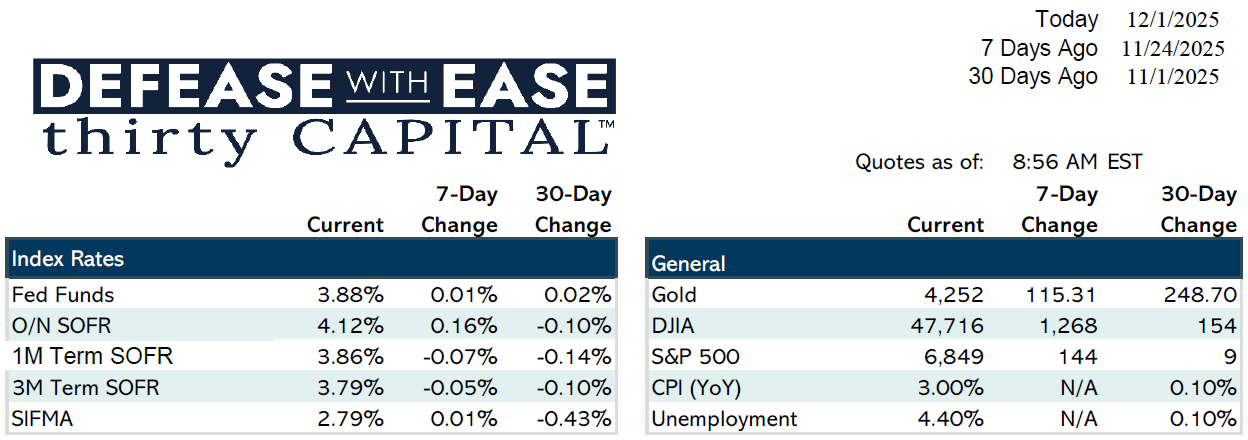

With a short, quiet week behind us, markets were mostly steady. Data was limited, but what did arrive skewed dovish: retail sales disappointed, PPI (delayed) ticked higher, and consumer sentiment collapsed. Despite that backdrop, rates and swap markets ended the week essentially flat. Odds of a December Fed cut now sit near 99%, with roughly three cuts priced in for 2026.

Inflation remains sticky enough to keep long-term yields resilient, while short-term rates continue adjusting toward expectations of a December move. Term SOFR was the only notable mover on the curve last week, falling about 10 bps as month-end funding pressures eased and the coming cut became more fully priced.

From a hedging standpoint, swap levels remain stable and fairly valued. The preferred window continues to be the 2–3-year sector for borrowers seeking flexibility without overcommitting to long-term exposure. Markets remain noisy, and thin year-end liquidity means execution windows can be narrow—if a hedge is required, the guidance remains: get it done rather than try to time it.

Agency desks reported minimal activity, consistent with seasonally light issuance. On the lending side, multifamily and retail continue to dominate pipelines. CMBS executions last month ranged from the mid-5s to mid-6s, including several full-IO 5- and 10-year deals. With year-end closing schedules tightening, any deal requiring rating-agency consent effectively needs to be in this week.

Looking ahead, this is another light data week until Friday’s PCE report, the Fed’s preferred inflation gauge. Powell speaks today, though policy commentary is limited by the blackout period. Expect low liquidity and potentially elevated rate volatility into year-end.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.