Market Recap & Outlook

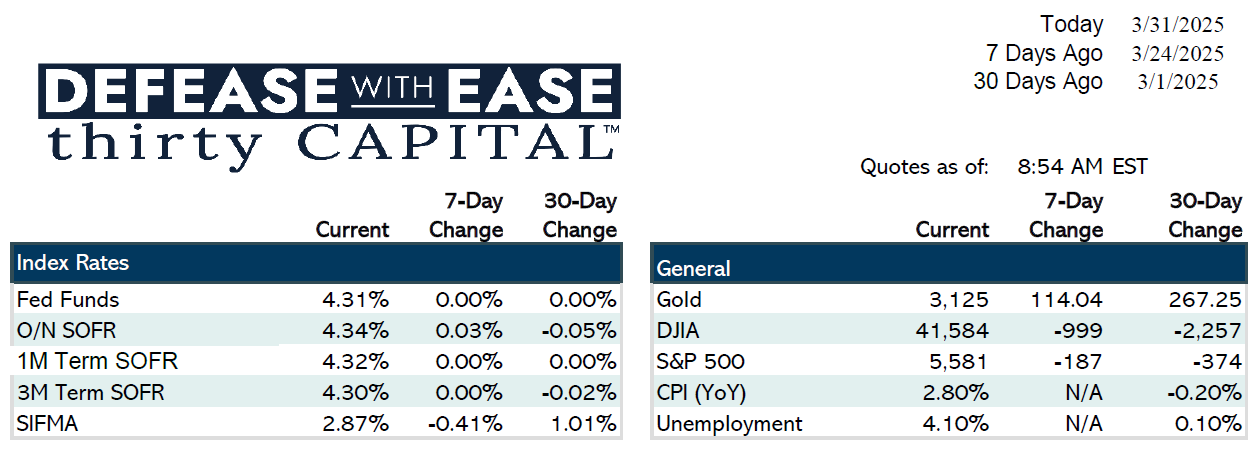

As we wrap up the quarter, markets remained surprisingly stable despite last week’s chatter. Short-term rates saw a modest rally, with 2-year yields down 4 bps and 10-year yields down 2 bps. Over the month, the 2-year dropped 10 bps, while the 10-year swap rate was nearly unchanged—an unexpectedly calm backdrop given ongoing economic uncertainties.

Key Data from Last Week

- Consumer Confidence fell to 92.9 (the lowest since January 2021), reflecting ongoing concerns.

- PCE Inflation (the Fed’s preferred measure) came in largely as expected:

- Headline PCE: +0.3% MoM

- Core PCE: +0.4% MoM (a slight uptick)

- Annual Core PCE: 2.8% (up 10 bps)

- Personal Income saw a slight increase, while spending was lower than anticipated, aligning with weaker consumer confidence.

This Week’s Focus

- Jobs Data: JOLTS report on Tuesday and Non-Farm Payrolls on Friday (expected: +138K jobs, unemployment steady at 4.1%).

- Tariffs: Markets await Wednesday’s official announcement on new trade tariffs, a potential driver of volatility.

Market Trends

- Rotation to Bonds: With rising concerns over tariffs and economic slowing, cash is moving out of equities into Treasuries.

- Agency & CMBS Activity: Some borrowers are shifting from agency to CMBS loans due to faster execution times.

- Defeasance & Cash Buyers: Increased defeasance activity as cash buyers dominate sub-$5M deals, particularly in triple-net retail properties.

Client Strategy Reminder

- Cap Renewals & Escrow Utilization: Borrowers with 2-3 years left on floating-rate agency loans should explore using built-up escrows to fund cap renewals, preserving cash flow and reducing ongoing escrow burdens.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.