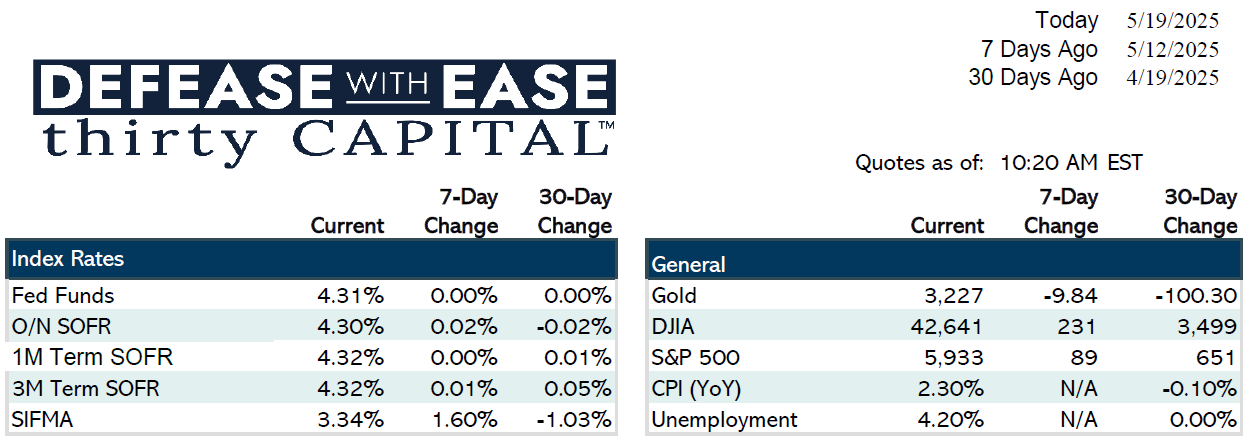

Markets had a relatively quiet week with limited economic data. Inflation prints came in soft, with April’s Producer Price Index (PPI) showing its largest monthly drop in five years at -0.5%, while Consumer Price Index (CPI) rose a modest 0.2%. Despite the softer numbers, interest rates edged slightly higher on the week, as the Federal Reserve remains in a “wait and see” mode, showing no urgency to begin rate cuts. Markets continue to expect the first cut around Q4 2025, with only two cuts currently priced in through next year.

Retail sales held up reasonably well, and the long end of the yield curve saw upward movement. The 10-year swap rate briefly broke 4%, closing the week at 3.95%, while the 2-year swap rose 12 basis points.

A notable development over the weekend was Moody’s downgrade of U.S. sovereign debt, removing its final AAA rating. While not a major market mover yet, potential follow-on downgrades—especially for agencies—are being closely monitored, particularly for their implications in the municipal bond market where AAA ratings are often contractually required.

On the fixed income front, agency supply remains low, and demand continues for specific structures, especially strips out toward 2029–2032. Traders are keeping an eye on potential agency downgrades and any ripple effects on spreads.

On Capitol Hill, a new tax bill emerged from committee, though it’s closely aligned with former President Trump’s policy proposals. Major provisions are set to expire post-2028, and funding cuts—especially to programs like SNAP—are drawing criticism. Despite a push to pass the bill soon, internal GOP divisions may slow its progress.

Pipeline activity remains stable, and market participants are watching how the treasury downgrade and upcoming Fed commentary could influence rates in the near term.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.