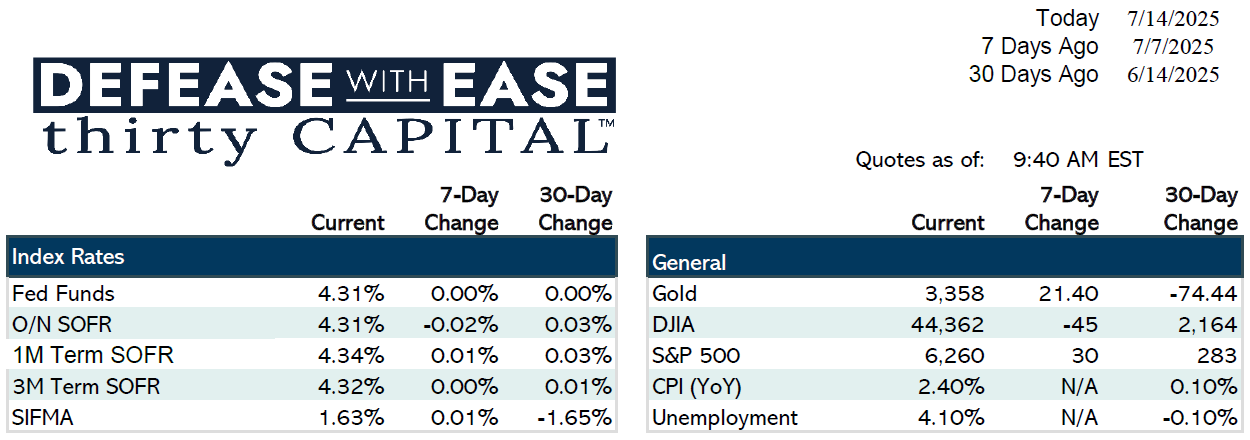

Last week was relatively quiet on the economic front, with markets primarily focused on the release of FOMC minutes. Rates moved modestly, with 2-year swaps up 1 bp and 10-year swaps up 5 bps. The Fed maintained a cautious tone, signaling no near-term cuts, though markets still price in two cuts in 2025 and three more in 2026—exceeding the Fed’s own projections. A well-received 10-year Treasury auction and lower-than-expected jobless claims (227K vs. 235K expected) supported that sentiment.

This week, attention turns to a busy data calendar, led by CPI on Tuesday and PPI Wednesday. June’s CPI is expected to show a slight uptick, with tariff impacts beginning to surface. Markets also await retail sales, consumer sentiment, and updated inflation expectations later in the week.

On policy, proposed changes to the Supplemental Leverage Ratio (SLR) could increase bank demand for Treasuries and potentially narrow negative swap spreads—currently at historically wide levels (2-year: -26 bps; 10-year: -56 bps vs. Treasury).

In the capital markets, swaps continue to price favorably relative to Treasuries, benefiting long-term financing strategies like CMBS. While swap-based pricing is currently advantageous, changes to leverage regulations could alter this dynamic.

From a macro view, uncertainty remains high. Some investors are fading rate-cut expectations entirely—one notable Citadel voice even predicts no cuts in 2025, citing inflation and long-end volatility concerns. The Fed’s focus appears centered on maintaining credibility, especially in a politically sensitive environment. Equity markets remain risk-on, buoyed by strong travel sector earnings and positive forward guidance.

Trends:

- Equity sentiment is cautious. Private equity remains active, favoring value-add and opportunistic plays.

- Debt maturity wall remains a challenge: $620B of CRE debt matures in 2H 2025. Loan modifications have doubled YoY (~$400B) as lenders seek to avoid defaults.

- Cap costs remain low, creating opportunities for high-strike, cost-efficient hedging. Floating-rate borrowers may benefit from shorter hedge durations if cuts materialize in late 2025 or 2026.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.