Market Recap – March 17, 2025

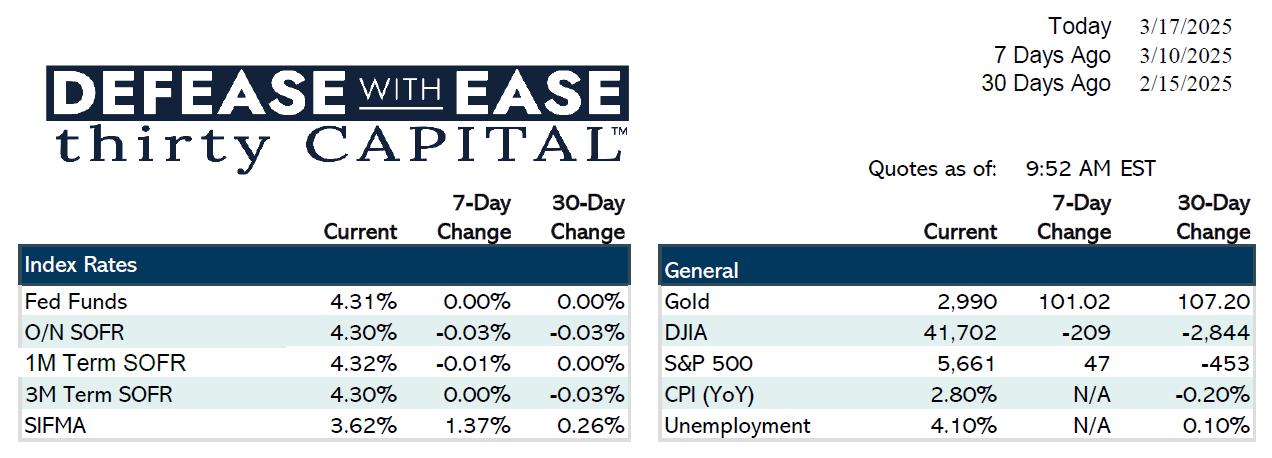

Last week saw heightened volatility with rates despite only slight moves in yields WoW. The 2-year swap rate increased by 2 basis points, while the 10-year swap rate rose by 3 basis points. However, daily fluctuations exceeded 6 basis points, underscoring the unpredictability in rates.

Economic data was mixed. The JOLTS report showed stronger-than-expected job openings (7.74M vs. 7.6M forecast), reinforcing labor market resilience. Meanwhile, inflation data suggested moderation. CPI for February came in at +0.2% for both headline and core, lower than expectations and a marked slowdown from January. PPI also showed softer-than-expected readings, with core PPI printing negative (-0.1%), the lowest reading since July 2024.

Despite easing inflation, consumer sentiment deteriorated sharply. The University of Michigan’s Consumer Sentiment Index dropped to 57.9 (vs. 63 expected), with 1-year inflation expectations rising to 4.9% from 4.3%. This divergence highlights ongoing concerns about long-term economic conditions.

Looking ahead, all eyes are on the FOMC meeting this Wednesday. While no rate changes are expected, updated economic projections could provide insight into future policy. The market is currently pricing in 64 basis points of rate cuts in 2025, compared to the Fed’s December projection of 50 bps. Balance sheet policy discussions will also be closely monitored.

In the financing space, discussions around hedging strategies continue. With a historically flat yield curve, forward-starting swaps are an appealing option for borrowers looking to hedge long-term rates while maintaining flexibility for potential near-term Fed cuts. Swap spreads remain negative, meaning swap-based financing could offer advantages over traditional fixed-rate loans.

On the policy front, the government averted a shutdown last Friday, with spending secured through September. However, debates over budget cuts, particularly in healthcare, remain ongoing.

Markets remain volatile, and key risk events this week—including the FOMC decision—will be critical for rate direction and investor sentiment.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.