Last week’s markets were driven by a moderate CPI report and continued uncertainty from the ongoing government shutdown. Both headline and core CPI eased slightly, suggesting broader moderation across goods and services. However, the shutdown has begun to distort data flow, delaying reports like housing starts and permits and making it harder to gauge real momentum. The CPI print largely solidified expectations for a Fed rate cut in December.

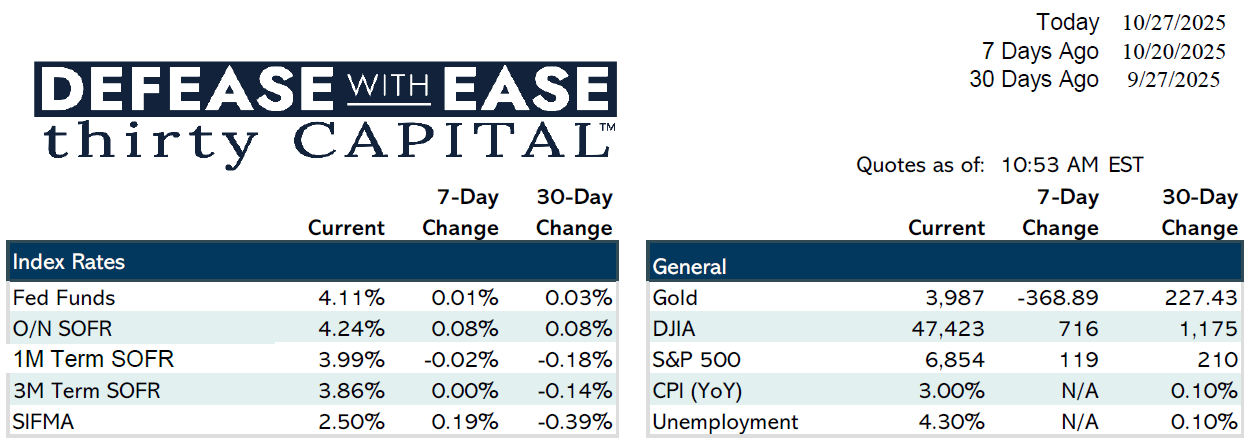

Yields moved lower across the curve, with the 10-year Treasury falling roughly 10 bps on the week. The SOFR curve flattened, as futures now price in up to three cuts over the next four meetings — a pace many see as aggressive. Fixed SOFR remains 70–80 bps inside floating, creating a short window for borrowers to synthetically fix at a discount. Overnight SOFR has traded above Fed Funds, reflecting repo market tightness and potential Fed concern over liquidity as quantitative tightening winds down.

Lending and market activity remain steady. Refi and CMBS pipelines are growing, and borrower engagement is improving, with competitive refi quotes of 100–125 bps over the 5-year Treasury and flexible 90-day locks. On the political front, the government shutdown is now the second-longest on record, with limited progress toward a resolution. Both sides remain entrenched as the economic and social impacts expand.

Looking ahead, markets will focus on this week’s FOMC meeting, GDP, and PCE inflation data. Borrowers should look to lock trades early and consider swaps to hedge against short-term volatility as the Fed’s next move comes into focus.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.