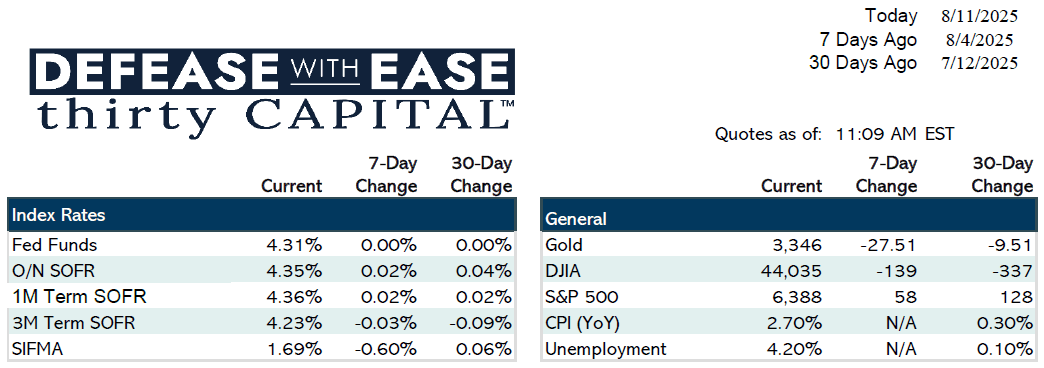

Markets entered the week focused on upcoming inflation data after a relatively quiet stretch for economic releases. Two weeks ago, a weak jobs report and a major downward revision to May and June employment—over 250,000 jobs cut from prior estimates—shifted sentiment toward September rate cuts. Labor force participation also fell to its lowest level since 2022, reinforcing expectations for easier policy.

Last week, Treasury auctions ranged from mediocre (3-year) to poor (10- and 30-year), while ISM services data showed slowing activity (50.1) alongside hotter-than-expected prices. Rates ticked slightly higher—1-year Swaps at 3.93% and 10-year Swaps at 4.27%—after late-July’s sharp drop.

This week’s key drivers are CPI (Tuesday, +0.2% expected), PPI (Thursday), and retail sales and Michigan sentiment (Friday). September cuts remain ~88% priced in, with the possibility of a double cut if inflation stays contained.

On the agency side, the administration is reportedly floating a 10–15% IPO of Fannie Mae and Freddie Mac by year-end, potentially raising $30B. The plan hasn’t impacted spreads or issuance, but consolidation rumors persist. Borrowers continue to favor floating-rate, short-term bridge debt (3–5 years), with advisors steering toward term SOFR to capture expected cuts and, in some cases, shorter interest rate caps (3–6 months) for flexibility ahead of potential property sales.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.