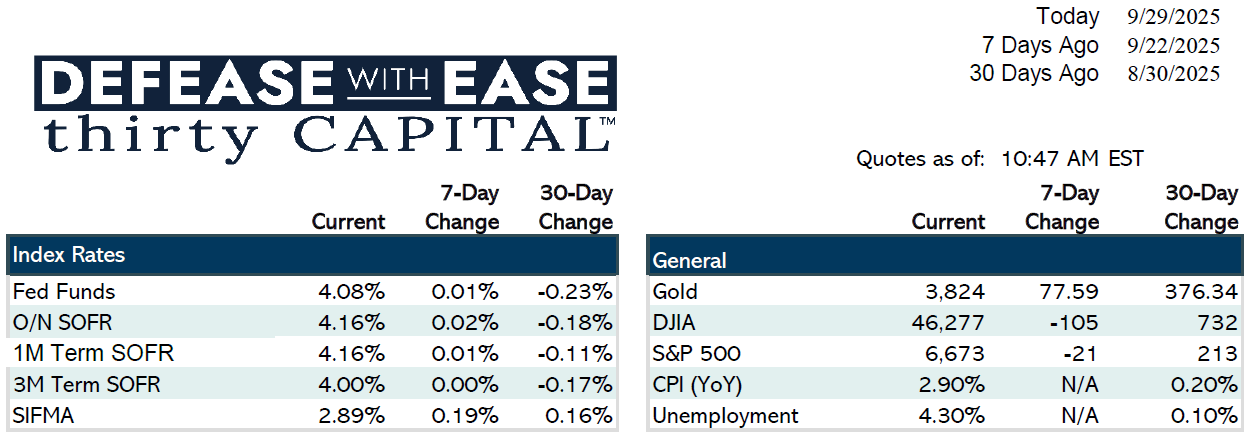

Markets were reminded last week that they often get ahead of themselves. Following the Fed’s recent cut, traders rushed to price in four more, but Powell pushed back, stressing sticky inflation. As a result, rates across the curve moved higher, echoing last year’s post-cut repricing.

Economic data remains strong: GDP rose 3.8%, durable goods orders jumped 2.9%, and jobless claims hit historic lows. Core PCE ticked lower, but not enough to justify an aggressive easing path. Yields are bouncing off key Fibonacci retracement levels, suggesting near-term upside risk. Borrowers should consider locking rates now.

Swaps and Treasuries both repriced higher, with two-year swaps up ~20 bps over two weeks. Fixed income flows show agencies favoring floaters and callables, with spreads near zero. A looming government shutdown could delay labor data and add volatility.

In CRE finance, tighter senior loan proceeds are pushing more borrowers toward pref equity and mezzanine capital. Cap rates in multifamily appear to be stabilizing, with early signs of rent growth returning, potentially signaling sector recovery.

Takeaway: Expect “higher for longer” rates, more complex capital stacks, and potential volatility from politics and data delays. Borrowers should hedge early and move quickly on execution.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.