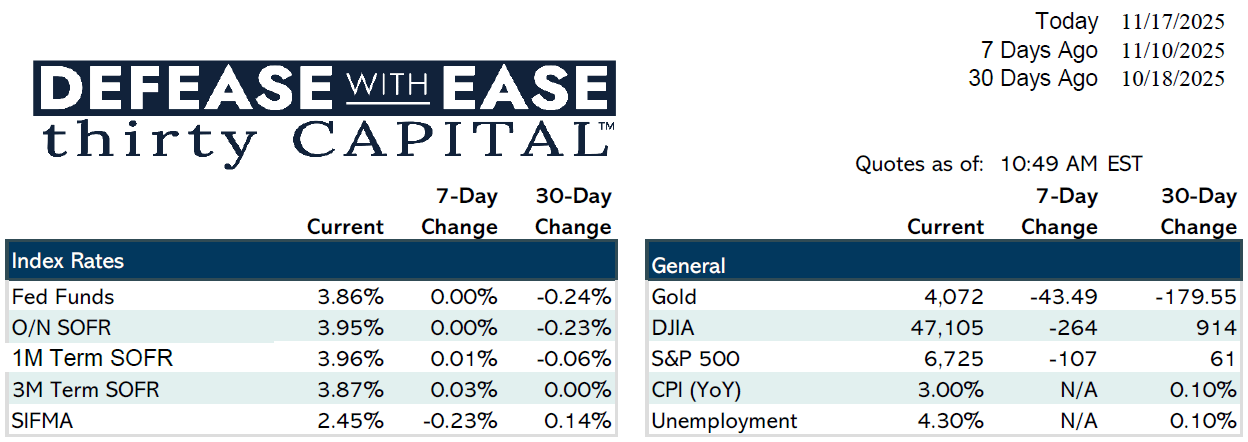

With the government officially reopened, markets are easing back into their normal rhythm, though the flow of economic data remains limited. Rates were essentially unchanged week-over-week, and without fresh prints to anchor expectations, price action has been driven largely by a steady stream of FOMC commentary. The most attractive point on the curve continues to be the 2–3 year sector, where yields around 3.6% offer the strongest entry opportunity.

Fed messaging remains mixed, and the probability of a December rate cut has slipped to about 40%, contributing to choppiness on the front end. Two-year swaps have climbed roughly 20 bps over the past month, while 10-year swaps remain about 55 bps above recent lows. Short-term funding markets are still signaling some strain, with SOFR consistently trading above Fed Funds, a dynamic that supports expectations for the Fed to pause quantitative tightening and keep liquidity intact.

This week should bring more definition. FOMC minutes on Wednesday may clarify internal divisions, and Thursday will deliver the first meaningful data in weeks, including initial jobless claims and delayed September nonfarm payrolls. Depending on the strength of the labor numbers, front-end volatility could pick up quickly.

Politically, the funding extension only runs through January, and broader budget debates are expected to resume in December, though markets anticipate relatively quiet conditions through the holidays. On the supply side, Treasury issuance remains steady, with 20-year and 10-year auctions this week and 2-year notes on deck next week.

In lending markets, distress-related conversations continue. Borrowers facing covenant pressure or constrained DSCRs are increasingly using rate cap purchases as a tool to meet extension requirements without large principal paydowns. Coverage metrics, including debt yield and DSCR, remain the key constraints for post-2022 financing.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.