The U.S. government shutdown has reached its 33rd day, nearing a record and delaying most economic data releases. Despite limited data, markets continue reacting to last week’s Fed meeting, where rates were cut 25 bps, but Chair Powell emphasized that another cut in December is “not a given.” As a result, market odds of a December cut fell from 90% to about 67%.

Consumer confidence ticked up to 94.6, though still near post-COVID lows. The Fed appears to be winding down quantitative tightening, increasing Treasury bill purchases to improve liquidity management. This week’s focus will be on ISM services data and Wednesday’s ADP employment report, given the lack of other government releases.

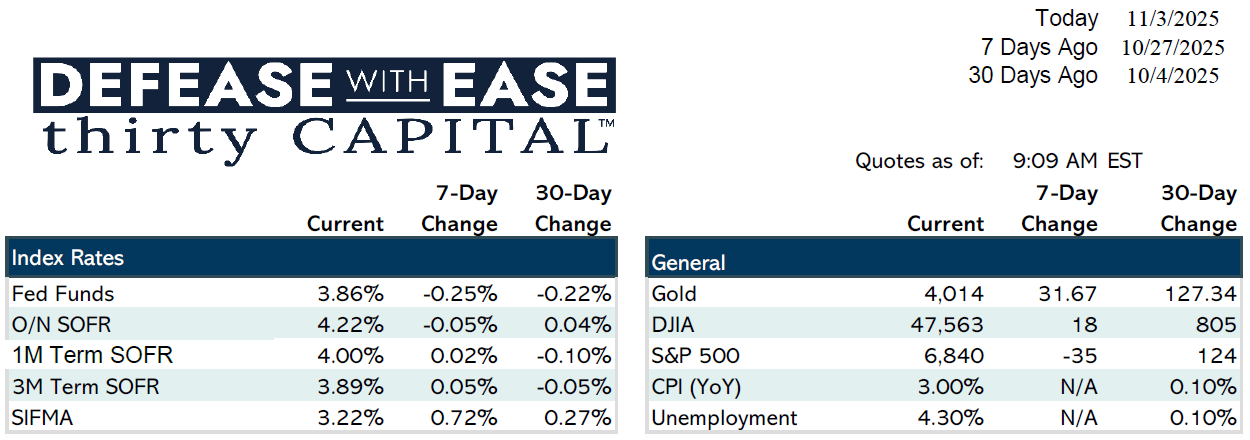

Rates rose modestly, with the 2-year swap up 11 bps to 3.37% and the 10-year up 9 bps to 3.65%. Overnight SOFR is trading near 4.04%. Borrowers who executed hedges early benefited from lower prior rates, reinforcing the need for proactive risk management amid uncertainty.

The Fed’s more cautious tone reshaped the yield curve and that Treasury issuance is shifting toward shorter maturities to maintain liquidity flexibility. Repo rates remain slightly elevated following a $52B drawdown from the Fed’s standing repo facility.

Treasury yields climbed 8–13 bps on the week, with the 10-year back above 4.1%. Retail and multifamily remain the most active sectors, followed by hospitality. CMBS and regional banks continue to provide the majority of new debt, with some all-cash transactions still closing. With year-end approaching, borrowers are advised to complete KYC and documentation early to avoid holiday delays.

Politically, there’s still no clear path to reopening the government, though mounting pressure from airport delays and food bank shortages could force progress in the coming weeks.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.