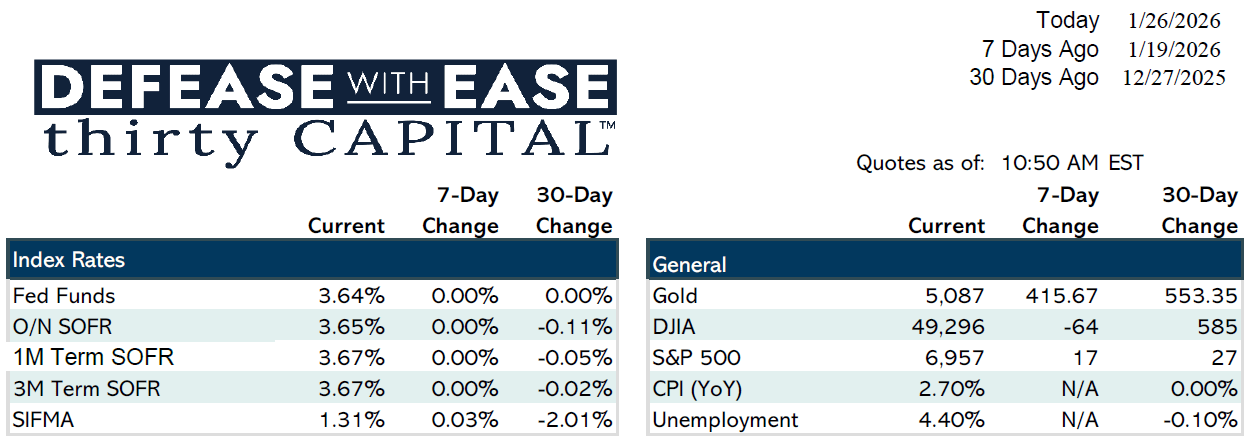

Rates remain range-bound with an upward bias. The 10-year Treasury has broken above recent resistance, while the front end continues to hold support, favoring a steeper curve. Strong economic data is keeping yields elevated, with GDP revised to 4.4%, low jobless claims, and core PCE at 2.8%. The “higher for longer” narrative remains in place, with upside risk toward 5% on the 10-year if rates break higher.

Given uncertainty around the path of rates, hedging remains a key theme, particularly for borrowers facing refinancing or DSCR pressure. Forward hedges and bridge-to-perm strategies are effective tools in the current environment.

Markets are focused on this week’s FOMC meeting. No rate move is expected, and fewer than two cuts are now priced for 2026, with the first not fully expected until late July. Sticky inflation, solid growth, and political uncertainty—including speculation around future Fed leadership—continue to cloud the rate outlook. Despite this, volatility across fixed income and equities remains near cycle lows.

Agency spreads tightened on favorable technicals and limited supply, while borrower execution conditions remain constructive. In CRE credit, CMBS issuance has started the year strong, with spreads tightening versus late 2025 levels. While roughly $100 billion of maturities come due this year, most participants expect extensions, modifications, and refinancing solutions—particularly for floating-rate loans—rather than widespread distress.

The week ahead is heavy on Fed and inflation data, led by Wednesday’s FOMC decision and Powell’s press conference, followed by PCE, jobless claims, and PPI later in the week.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.