Markets opened the week cautiously optimistic as Congress appeared close to a short-term deal to reopen the government through January, easing recent uncertainty.

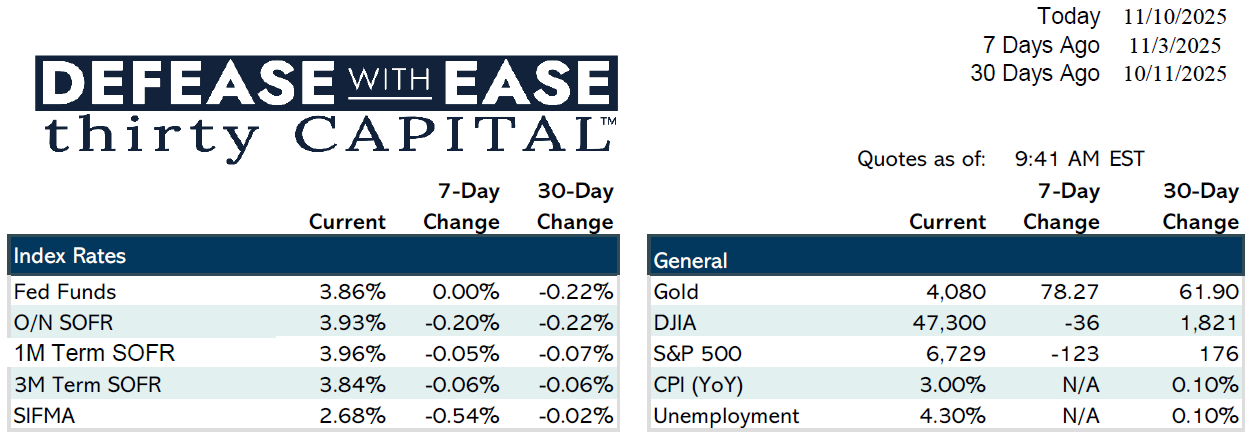

The Treasury curve held mostly steady with mild steepening — the 1-year around 3.65% and the 10-year near 4.12%. Liquidity in repo markets remains tight but has improved, with SOFR trading about 7 bps above Fed funds. Treasury auctions dominate this week’s calendar with 3-, 10-, and 30-year issuance.

Economic releases depend on when the government reopens. Key data expected include CPI and jobless claims Thursday and PPI and retail sales Friday. Last week’s ISM services and ADP jobs reports beat expectations, while U Mich sentiment softened.

Debt markets remain flat as most new deals shift to 2026 vintage. Agency spreads are holding in the 110–130 bps range for year-end loans, widening modestly for 2026. Markets still price in a two-thirds chance of another Fed rate cut before year-end.

In funding markets, repo pressures from heavy Treasury issuance have eased, though dealers continue to watch for volatility. Swap curves remain steep, with 10-year rates about 50 bps higher than in September.

With Veterans Day closing bond markets Tuesday, trading is expected to stay range-bound as investors await fresh inflation data and clarity on Washington’s budget deal.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.