Markets were largely rangebound last week as the ongoing government shutdown delayed key data and fueled policy uncertainty. The two main drivers were softer economic readings and persistent inflation.

ISM Services came in weaker than expected, with new orders slowing and prices paid rising. The ADP report showed a 32,000 job decline in September, marking three of the last four months negative. Still, markets viewed the weakness as a hiring pause rather than broad layoffs.

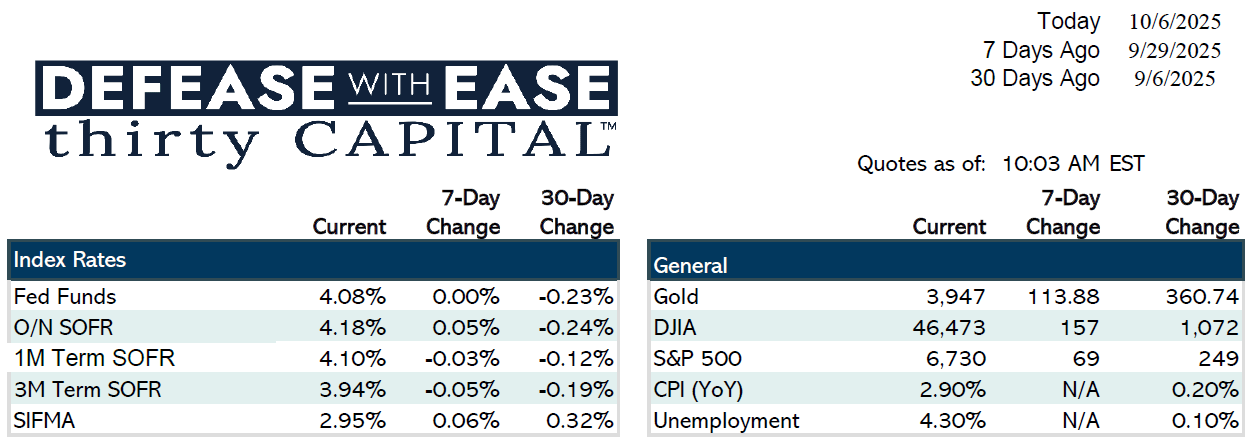

Rates ended the week mostly flat, with modest steepening across the curve. Swap markets are pricing in roughly two rate cuts by year-end and several more through 2026, leaving the front end deeply inverted.

Borrowers continue to benefit from attractive swap spreads (two-year SOFR swaps are roughly 23 bps below Treasuries and 10-year swaps about 50 bps lower), making swap-based debt structures appealing relative to Treasury-indexed alternatives.

With limited data this week, focus turns to FOMC minutes and University of Michigan sentiment, ahead of next week’s CPI and PPI releases.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.