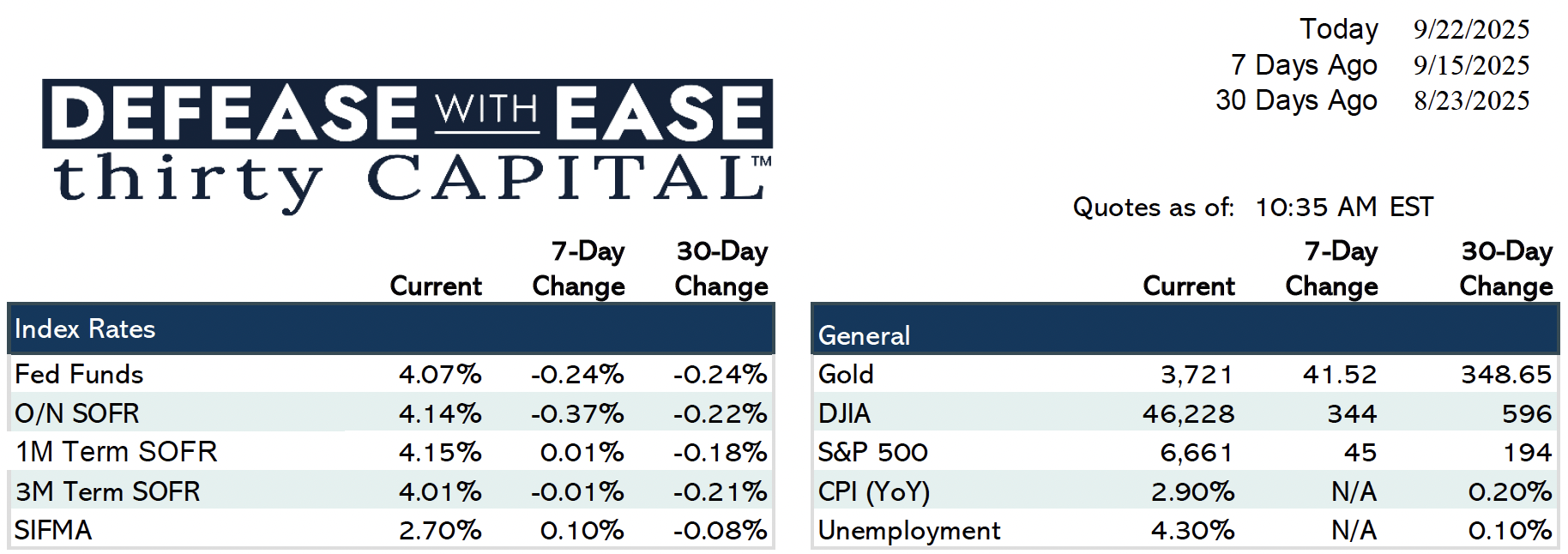

The Fed cut rates by 25 bps last week, while updated dot plots signaled two additional cuts this year—largely in line with market expectations. However, uncertainty remains as the labor market shows signs of cooling and inflation stays sticky. Futures markets are pricing in slightly more easing than the Fed’s median forecast, particularly into 2026, though the dispersion of projections highlights uncertainty.

Markets reacted with higher rates: two-year swaps rose 2 bps, and ten-year swaps climbed 7 bps. Strong August retail sales (+0.6%) underscored consumer resilience, while housing starts disappointed, continuing a trend of undersupply. Jobless claims moderated back toward normal levels, reinforcing the view of a still-healthy labor market.

Looking ahead, the key data release this week is Friday’s PCE inflation report—the Fed’s preferred gauge—with expectations of a modest uptick to 2.7% YoY on headline. Fed officials will also be speaking throughout the week, and Treasury auctions across the curve will test demand.

In housing, existing home sales remain slow amid limited supply, while multifamily faces oversupply and rising concessions. On the credit side, spreads remain tight, issuance light, and repo markets stable heading into quarter-end. Deal activity is improving modestly as lender spreads compress, with hopes for stronger momentum into Q4.

Overall, markets are pricing a more dovish path than the Fed suggests, but inflation remains the swing factor. Near-term, shorter-term hedges remain attractive, particularly as clients look to lock in protection ahead of PCE.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.