Financial markets head into the week on edge as investors await Wednesday’s Fed meeting, which could mark a major turning point for monetary policy. Last week’s data painted a mixed picture. PPI came in below expectations and CPI was in line, but the Bureau of Labor Statistics delivered a shock with a historic downward revision of roughly 900,000 jobs between March 2024 and March 2025 — the largest on record. The latest report showed just 263,000 new jobs, reinforcing evidence of a cooling labor market.

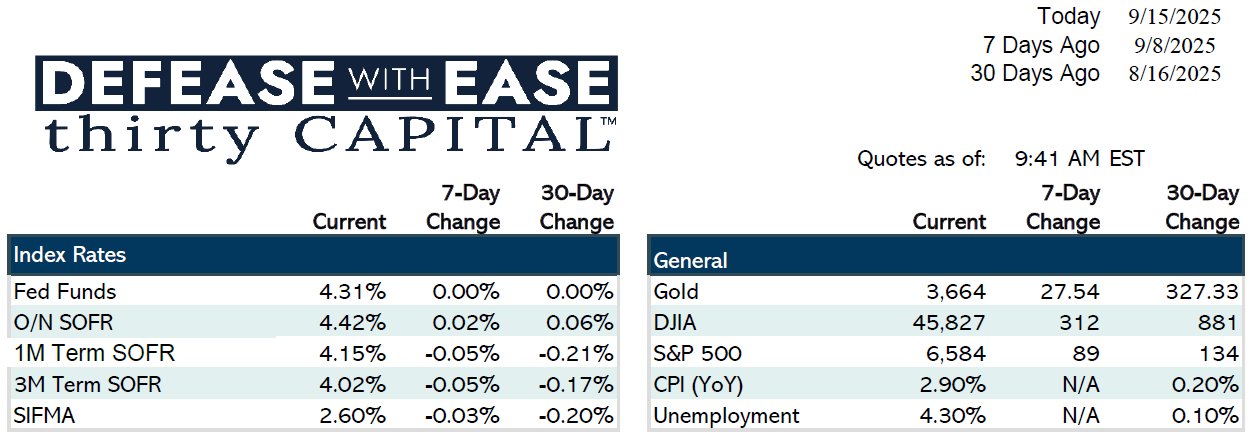

Despite softer employment data, rates ended higher. The 2-year Treasury, which touched a two-year low early in the week, reversed and closed stronger by Friday. Funding markets also tightened, with overnight SOFR climbing to 4.42%, well above one-month term SOFR at 4.15%, underscoring expectations for Fed action.

Markets currently anticipate a 25-basis point cut, though debate remains over a larger 50 bp move or even no cut. The updated dot plot and Powell’s commentary will be critical for gauging the pace of easing into 2026. Commercial real estate faces its own pressures, with more than $400 billion in maturities due by year-end. Capital is concentrating on newer, well-located assets, while older offices face obsolescence. Resilient sectors include senior housing, medical office, data centers, logistics, and affordable multifamily, supported by demographic and structural demand. Cap rates are widening in weaker markets but remain compressed in Sunbelt multifamily and industrial hubs.

With the labor market weakening and inflation still near 3%, the Fed faces pressure from both sides of its mandate. This week’s meeting will set the tone for markets into year-end, with volatility likely regardless of the outcome.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.