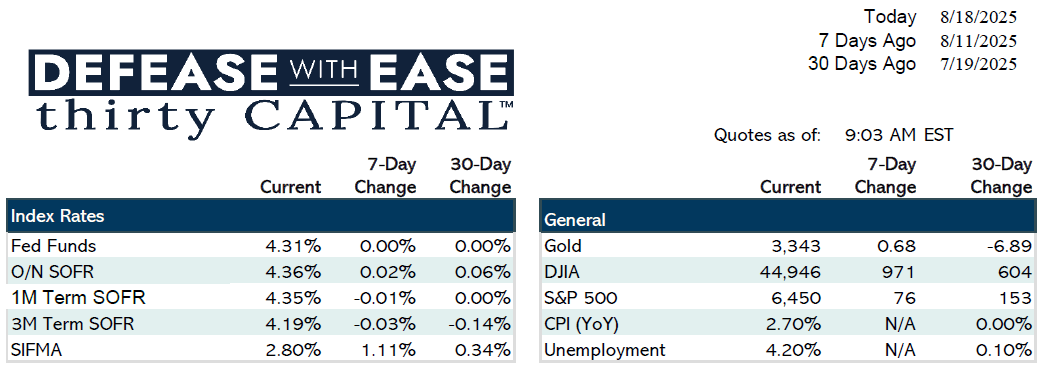

Markets digested mixed inflation data last week. CPI came in largely as expected—headline up 0.2% and core up 0.3%—while PPI surprised sharply higher at 0.9% versus 0.2% expected. Despite the miss, investors expect little passthrough to PCE, the Fed’s preferred gauge, keeping market reaction muted.

Rates saw modest moves: two-year swaps slipped 1 basis point while 10-year swaps rose 4, extending the recent steepening of the yield curve. Longer-term pressures from deficits, trade shifts, and geopolitical tensions remain key drivers.

In housing finance, talk of a Fannie/Freddie IPO has yet to materialize, with concerns that privatization could raise mortgage costs. Agency spreads and MBS valuations remain stable.

Commercial real estate lending spreads widened further—multifamily 150–165, industrial 153–165, retail 168–174, and office 203–220—with lenders tightening credit standards. Borrowers continue to favor shorter maturities, with the three-year sector still screening as the best relative value.

This week’s focus is squarely on the Fed. Wednesday’s FOMC minutes will shed light on July’s split decision, while Friday’s Jackson Hole speech from Chair Powell could clarify—or challenge—expectations for a September rate cut, now priced at roughly 85%.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.