Markets opened flat Monday despite significant geopolitical escalation, as the U.S. launched strikes on Iranian nuclear facilities over the weekend. Oil prices actually dipped, and equities held steady, suggesting investors see limited near-term risk of broader conflict.

Interest Rates & Fed Outlook

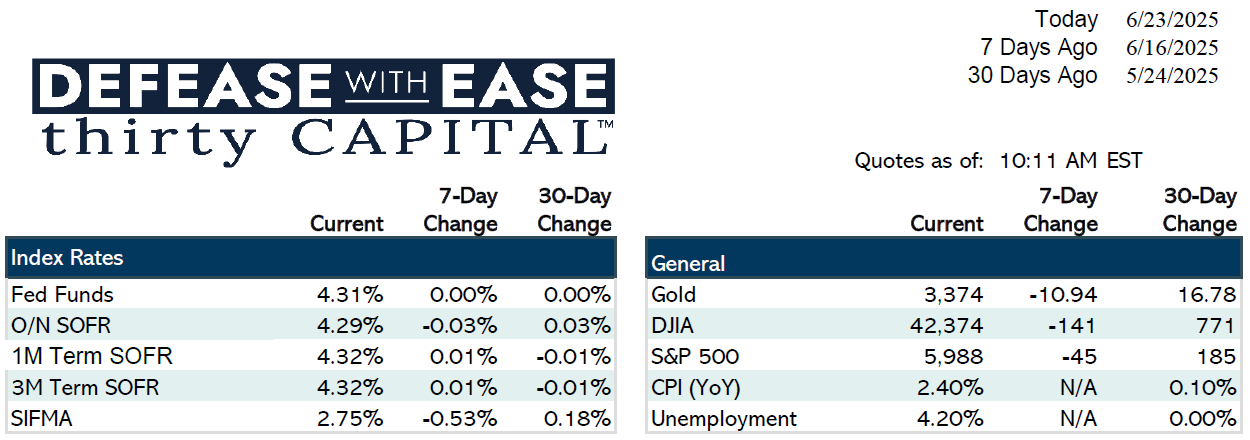

The Fed held rates steady at last week’s meeting. The updated dot plot revealed a divided committee: seven members see no cuts in 2025, while the median still expects two. Markets are pricing in two cuts this year and two more in early 2026. Despite the Fed’s cautious stance, some policymakers are pushing for rate cuts to begin soon, especially given weakening labor data and the deflationary impact of tariffs.

Short-term rates—particularly in the 2- and 3-year range—are likely to fall more quickly than long-term rates. The 5- and 10-year segments remain sticky due to persistent inflation concerns, but a favorable spread on a 5-year swap could still present a solid opportunity. Overall, the current environment favors short-duration hedging, with flexibility to adjust if the Fed pivots more aggressively.

Key Events This Week

- Fed Chair Powell delivers his semiannual testimony to Congress (Tues/Wed)

- $69B in Treasury auctions (2-, 5-, and 7-year notes)

- Weekly jobless claims (Thursday)

- Core PCE inflation data for May (Friday), expected to tick slightly higher due to base effects

Lending & Real Estate Trends

- Deal flow is picking up into quarter-end, led by strong activity in retail and multifamily sectors

- Wells Fargo is exiting the interest rate cap market, leaving Goldman Sachs and SMBC as primary providers. Borrowers with existing Wells caps should plan ahead for replacements.

Cap Market Insights

The price of 2-year, 5% caps has declined, tracking with a lower 2-year swap rate. This reflects lower expectations for interest rates exceeding 5%, further supporting a case for falling short-term rates.

Market Sentiment

The yield curve appears set to steepen, led by declines on the short end. As refinancing pressure builds and rate expectations shift lower, transactional momentum—especially in CRE—is likely to accelerate in the second half of the year.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.