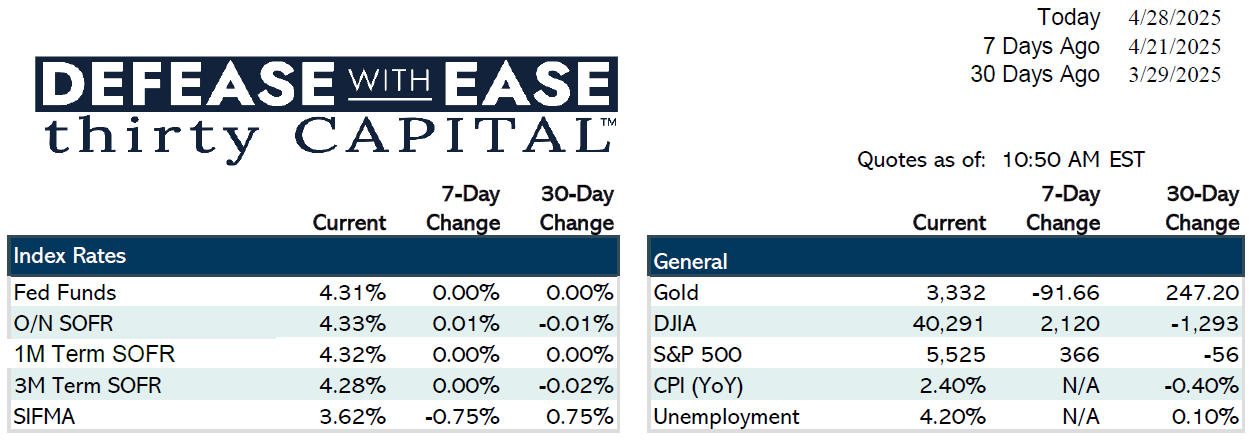

Markets remained relatively stable last week amid limited macroeconomic activity. A key highlight was Fed Governor Waller’s remarks suggesting the Fed would act quickly if the economy weakens, despite lingering inflation concerns — a message markets received positively. Treasury yields drifted slightly lower, with the 10-year and 2-year swap rates declining by about 7 and 3 basis points respectively.

As the Fed enters its pre-meeting blackout period ahead of the May 7 meeting, attention this week turns to a heavy slate of economic data: JOLTS job openings and consumer confidence (Tuesday), Q1 GDP (Wednesday), March PCE inflation (Wednesday), and April Nonfarm Payrolls (Friday). Market expectations are for sluggish GDP growth (potentially near zero) and softer jobs data, with unemployment holding steady at 4.2%. Inflation metrics, especially PCE, will be closely watched for signs of easing.

From a fixed income perspective, agency bullet spreads widened slightly, and swap spreads moved out, while agency issuance remains light. Volatility in funding markets continues, but funding costs have slightly improved.

On the mortgage and real estate finance side, borrower activity is up significantly year-over-year, driven partly by capital deployment needs. However, transaction delays are becoming more common, largely due to aggressive lender quoting that leads to late-stage retrades. Freddie and Fannie issuance remains strong, although reduced staffing is causing longer processing times. CMBS delinquency rates are ticking higher, particularly in multifamily, highlighting the importance of proactive asset management.

Overall, sentiment remains cautious. Clients are advised to hedge floating rate exposure where possible and be proactive given persistent uncertainty across economic data, interest rates, and political developments.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.