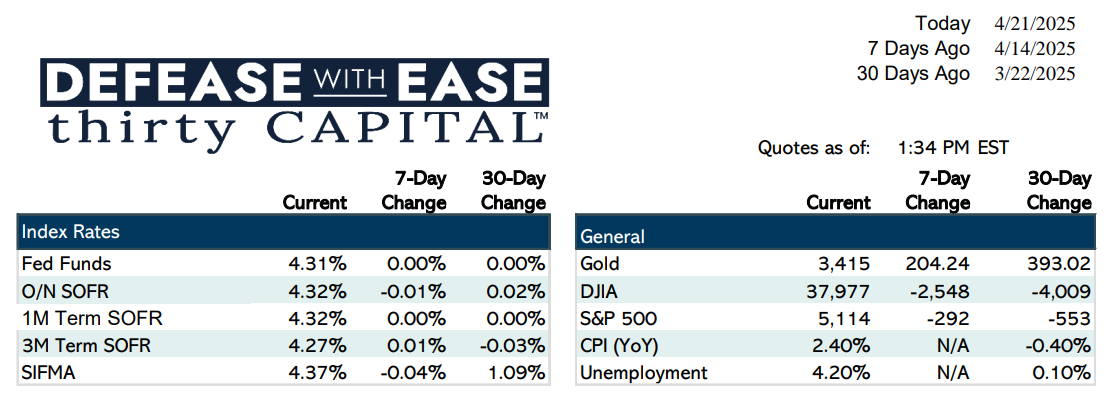

Markets saw another week of rate declines, with the 2-year yield dropping 17 basis points and the 10-year falling 13. This marks the third straight week of significant rate movement, averaging 25–28 basis points— highlighting persistent volatility.

Despite stronger-than-expected retail sales and improving jobless claims, markets largely shrugged off the data. Fed Chair Powell maintained a hawkish tone in his remarks, emphasizing patience on rate cuts and concern over inflation driven by tariffs. Still, the market appears skeptical, continuing to price in potential rate cuts on the expectation of softening labor conditions.

This Week: Auctions and Durable Goods in Focus

Looking ahead, durable goods data on Thursday will be the key economic release. Treasury supply will also be in focus, with $183 billion in 2-, 5-, and 7-year auctions throughout the week—critical given the current rate sensitivity and intraday volatility.

Borrowing Environment: Stay Ahead of Delays

Borrowers continue to face lender delays and extended negotiations across deal types. Starting conversations early and building flexibility into closings—especially around hedging tools like interest rate caps—is essential in this market. With cap pricing often spiking unexpectedly, securing extra time can help avoid costly execution risks.

Bottom Line: Position Proactively

Rates are drifting lower, but volatility remains high and sentiment—not data—is driving much of the movement. With curve inversion still present on the short end, forward-starting caps and shorter-duration instruments remain areas of opportunity. Staying nimble and proactive continues to be the best strategy in this uncertain environment.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.