Fed Holds Steady, Markets React

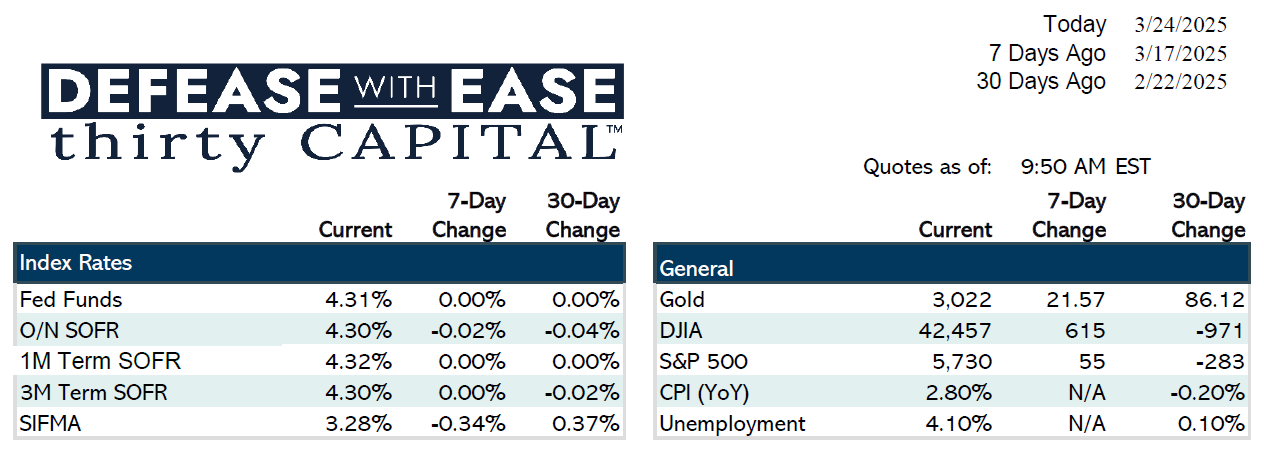

Last week, the Federal Reserve opted to hold interest rates steady, keeping the benchmark rate at 4.33%. Fed Chair Powell’s comments reinforced a “wait-and-see” stance, redefining why rate cuts remain on the table but without committing to a specific timeline. The market responded with a slight dip in yields, with two-year swap rates down 8 basis points and 10-year swap rates down 9 basis points, though some of that was reversed by the start of this week.

Economic Data & Market Trends

- Retail Sales: The headline retail sales figure for February came in lower than expected at +0.2% (vs. +0.6% expected), largely due to weakness in auto sales.

- Consumer Confidence: A key report to watch this week, the Conference Board’s consumer confidence index, is expected to fall to 93.6—the lowest since early 2021.

- Inflation & GDP Outlook: The Fed revised its GDP projection slightly downward while increasing inflation expectations. Friday’s PCE inflation report is forecasted to remain steady at +0.3% MoM, with core PCE potentially ticking up to 2.7% YoY.

Fixed Income & Credit Markets

- Treasury auctions this week will bring $183 billion in supply, with key auctions in the 2-year, 5-year, and 7-year sectors.

- Junk bond spreads are widening, reflecting growing concerns over credit markets, though major distress remains under the surface.

CRE & Agency Debt Trends

- Loan extensions remain prevalent, driven by rate uncertainty and lenders requiring additional equity injections for refinancing.

- Tariffs could drive construction costs up 3–5% later this year, potentially slowing new development projects.

- On the hedging side, extension volume is outweighing brand new trades by a significant margin. Borrowers are using caps to buy down rates in the 1.50-2.00% range.

Looking Ahead

This week’s key events include consumer confidence data on Tuesday, durable goods orders on Wednesday, and the all-important PCE inflation print on Friday. Markets remain sensitive to Fed policy signals and broader economic trends, with liquidity concerns and credit market stability in focus.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.