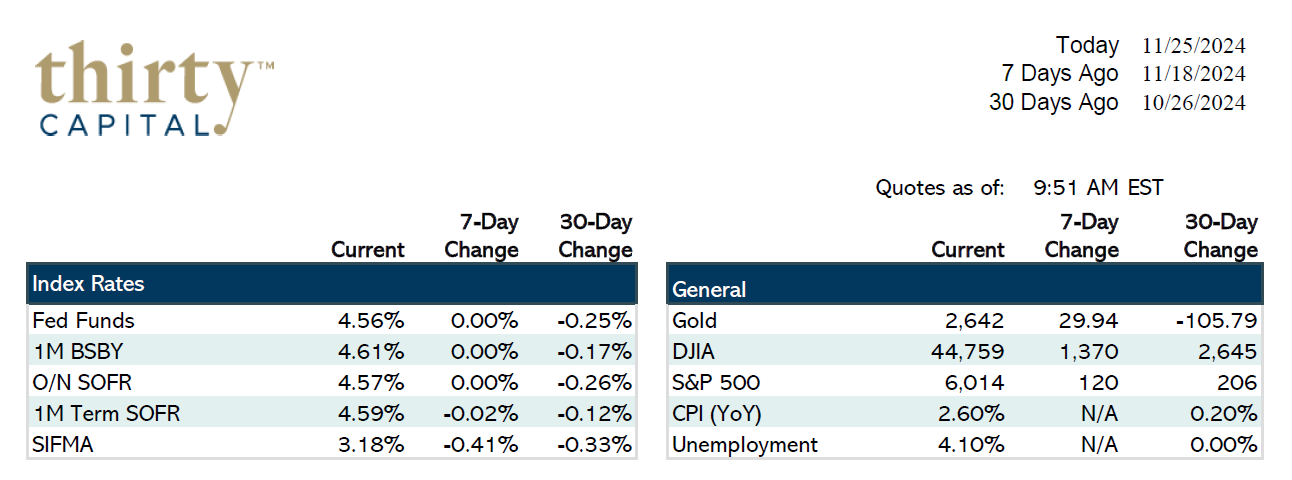

Last week was a quiet one on the economic data front. The short end of the curve moved up a bit, which can be attributed to the lower than anticipated Initial Jobless Claims number that came out on Thursday. 2’s to 10’s are now mostly flat, and rate cuts are aggressively getting priced out. There’s now slightly over a 50% chance for a cut in December and less than 3 total cuts priced in through the end of 2025. Neither of the notable TSY auctions last week went off particularly well.

This week is a short one with Thanksgiving on Thursday and an early market close on Friday. There are more TSY auctions worth following this week, and Minutes from the FOMC’s last meeting will be released tomorrow. Wednesday we’ll get PCE data from October which is expected to remain pretty consistent.

Jake Tillman, Senior Analyst

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.

Jake Tillman is a Senior Analyst, Capital Markets at Defease With Ease | Thirty Capital, bringing 5+ years of experience specializing in financial modeling, debt structuring, and risk analysis for CRE transactions. He supports the execution of financing strategies, including CMBS, as well as interest rate hedging and capital markets transactions. With expertise in cash flow modeling, credit risk assessment, and market analytics, he provides data-driven insights to optimize capital structures and manage interest rate exposure. Jake assists in scenario analysis, transaction execution, and risk assessments, ensuring alignment with market conditions and client objectives. His technical background includes financial modeling, Bloomberg analytics, and structured finance evaluation.